The world’s two biggest oil exporters seem to have finally figured out how to eliminate a global surplus that’s kept crude prices in check for almost three years.

Saudi Arabia and Russia said in Beijing on Monday they favor prolonging this year’s oil curbs to the first quarter of 2018. If they convince fellow producers to adopt the strategy when OPEC and its partners meet next week, it will pare near-record inventories in developed nations by 8 percent and erase the glut weighing on the market, according to Bloomberg calculations using U.S. government data.

“They have a very clear goal,” said Mike Wittner, head of oil market research at Societe Generale SA in New York. “They remain focused on having stocks get down to the five-year average. They really want to see it work.”

While news of the Saudi-Russia proposal helped send prices up to a two-week high, crude remains stuck near $50 a barrel, less than half the level traded in 2014. That’s because output cuts by OPEC and its allies have failed to drain bloated stockpiles as production rises in places like the U.S. and as demand growth slowed. Brent crude was trading little changed at $51.89 a barrel as of 12:32 p.m. in Singapore.

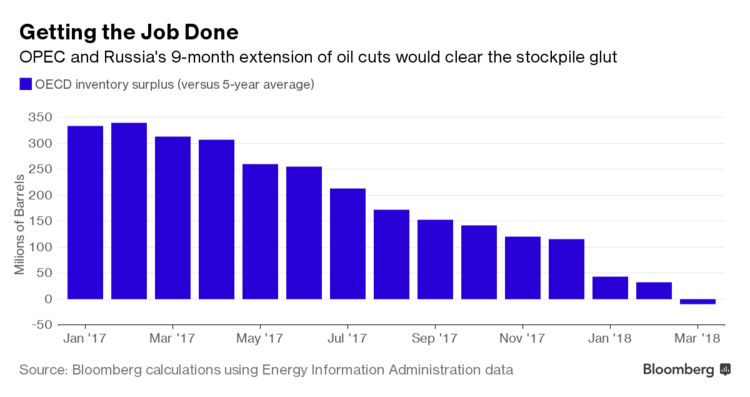

Inventories in the 35 of the world’s most industrialized nations — the Organization for Economic Cooperation and Development — were just above 3 billion barrels in April, or about 307 million above their five-year average, data from the U.S. Energy Information Administration shows.

If OPEC and Russia complete the nine-month extension, stocks will fall to about 10 million barrels below that average next March, according to Bloomberg calculations using the EIA’s numbers.

The calculations assume OPEC keeps its output at April levels of 31.7 million barrels a day, and that Russia keeps supply steady at 11.15 million a day from May. Those levels represent the full cuts they’d agreed to undertake in a deal reached last year.

OPEC’s own data suggest it could take even longer to eliminate the surplus, while figures from the International Energy Agency indicate it could happen sooner.

While supply cuts by OPEC and its partners would certainly play a significant part in reaching the five-year average, the producers are also set to receive a helping hand: oil markets have been oversupplied so long that their historical average is getting higher.

The five-year average for OECD stocks was at 2.71 billion barrels in January, according to the EIA. Yet, as years of elevated inventories push the average higher, by next January it will jump to 2.79 billion — making the task of hitting that target a little bit easier.

That still doesn’t mean success is straightforward. Fulfilling the plan, which started in January, would require OPEC to comply with output targets for 15 months, longer than the group has typically managed in the past.

Although a longer extension may achieve OPEC’s objective, it risks backfiring by giving extra support to rivals in the U.S. shale industry, according to Natixis SA. American oil explorers are using double the number of rigs they deployed a year ago, and the nation’s production is rebounding. OPEC last week raised its outlook for U.S. output growth this year by 285,000 barrels a day to 820,000 a day.

“It depends on how much the U.S. adds,” said Abhishek Deshpande, chief energy analyst at Natixis in London. “The problem is, will OPEC extend it further if oil gets supported and U.S. producers hedge more and increase oil production more?”