A new report claims to show that the oil market started to re-balance in the first quarter of 2017 but it may take longer for OPEC output cuts to be full effective.

The monthly International Energy Agency (IEA) report comes just a week before OPEC meet to decide whether to prolong the cuts agreed in November last year with certain other non-cartel member countries including Russia.

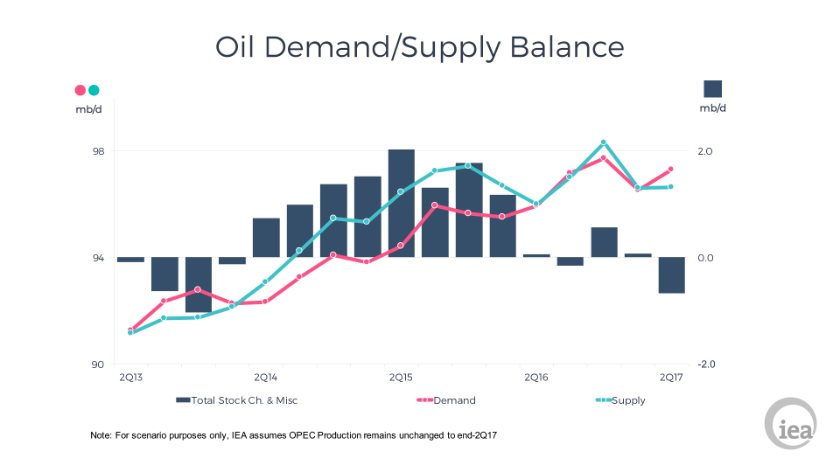

The IEA May report shows that in the first three months of the year the oil market was almost balanced with a global stock build of 0.1 mb/d.

For Organisation for Economic Co-operation and Development (OECD) countries, stocks grew by 0.3 mb/d for 1Q17 as a whole, nearly offset by observed falls in floating stocks and in other centres.

In March, total OECD stocks did fall by about 1 mb/d.

The report found that it has taken some time for stocks to reflect lower supply when volumes produced before output cuts by OPEC and eleven non-OPEC countries took effect are still being absorbed by the market.

The IEA added:: “”e might not have seen a resounding return to deficits but this report confirms our recent message that re-balancing is essentially here and, in the short term at least, is accelerating.”

If OPEC cuts are continued then stock draws are likely to continue in a positive trend.

But the report added: “Even if this turns out to be the case, stocks at the end of 2017 might not have fallen to the five-year average, suggesting that much work remains to be done in the second half of 2017 to drain them further.

“In addition to production cuts and steady demand growth, a major contribution to falling crude stocks in the next few months will be a ramp-up in global crude oil runs. Starting in March, refinery activity is building up and by July global crude throughputs will have increased by 2.7 mb/d.”

The report identified ramp up in US production as one of the wildcards that could derail these forecasted trends.

After bottoming out in September, output has increased by nearly 465 kb/d. In line with stronger recent performance from the US shale sector we have revised upwards our expectation throughout 2017 and we now expect

Total US crude production is expected to exit the year 790 kb/d higher than at the end of 2016.

This is an upward revision of 100 kb/d since the IEA’s report last month.

The overall outlook for the non-OPEC countries, eleven of which are voluntarily cutting production to support OPEC, shows growth in 2017 of nearly 600 kb/d, an increase on the 490 kb/d seen in last month’s report.

Libya and Nigeria were highlighted in the report as countries to watch, as production is expected to increasing rather than slowing.

Recommended for you