Solo Oil is pulling out of plans to invest another 10% interest in Norwegian gas explorer Helium One for a knockdown price.

The AIM-listed independent investment firm acquired the 10% interest in the company for £2.55million earlier this year.

It gave the business access to Helium One’s Rukwa Project in Tanzania – a gas field with an estimated recoverable helium volume close to 100 billion cubic feet (bcf).

Current global Helium demand is approximately 6 bcf making the recovery of “strategic global importance”.

The deal had the option for Solo to acquire another 10% of Helium One for an addition £4million – £2.0 million in cash and £2.0 million by the issue to Helium One of ordinary shares in Solo.

But in light of “market conditions” was reassessed earlirt this week to £3million in cash and a general meeting was called to get shareholder’s approval.

However, Solo said last night that it had “terminated plans” to raise funds to complete the additional transaction.

In a statement the firm said: “The board will continue to focus on the company’s existing investments, including the Ntorya gas condensate discovery in Tanzania, the Horse Hill oil discovery and the initial 10% stake in Helium One.

“The board considers the initial stake in Helium One to be a core investment of the Company with significant potential upside. Solo will therefore continue to play an important role in supporting Helium One as it progresses its strategic helium assets in Tanzania.”

The Board anticipates shortly publishing the Company’s Annual Report and Accounts for the year ending 31 December 2016 and calling an Annual General Meeting, and will outline its future investment plans and strategy to shareholders at that time.

Solo is waiting for approval for the Horse Hill Discovery on the south coast of England.

An application for long term production testing and further appraisal drilling is scheduled to be decided at the Council’s planning committee meeting in July 2017.

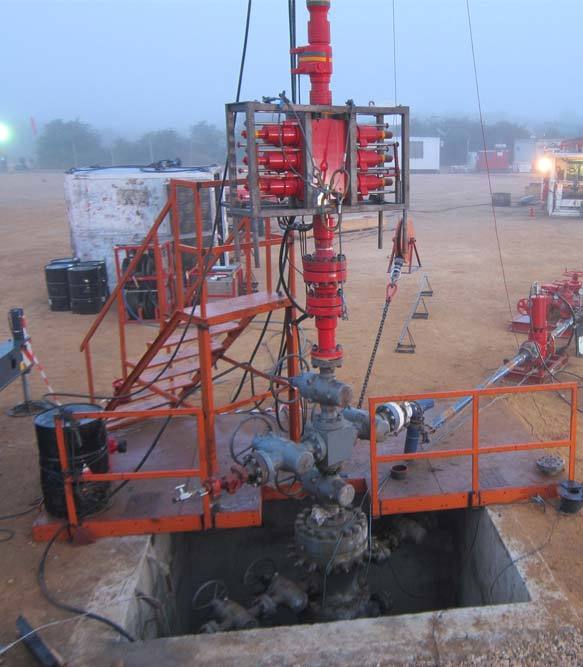

The Horse Hill-1 well Kimmeridge Limestone and Portland Sandstone conventional oil discovery is located on the northern side of the Weald Basin, approximately 3 kilometres north of Gatwick Airport.

It consists of two naturally-fractured limestone members within the Kimmeridge section, known as KL3 and KL4, flowed dry, 40 degree API oil, at an aggregate stabilised natural flow rate of 1,365 barrels per day (“bopd”) with no indication of depletion.

The overlying Portland flowed dry, 35-37 degree API gravity crude at a stable pumped rate of 323 bopd. The Portland was produced at the rod-pump’s maximum achievable rate and thus flow was constrained by the pump’s mechanical capacity.

Licence PEDL137 is operated by Horse Hill Developments Limited (“HHDL”) which holds a 65% interest and is the licence’s operator. Solo has a 10% ownership of HHDL which represents a 6.5% working interest in HH-1 and PEDL137.