Caution lights are flashing for the oil industry.

Facing lower-than-expected commodity prices, drillers from ConocoPhillips to Hess Corp. to Statoil ASA have slashed their capital spending plans in recent days, as companies lay out their plans to cope with oil prices stuck below $50 a barrel.

The budget cuts won’t necessarily mean less oil or natural gas on the market, with some of the companies saying they can now do more with less and expect to produce just as much oil and gas in 2017. But they speak to an investor community that’s grown anxious as a global rally in crude prices has stalled out this year.

“The expectation was that oil would be at least above $50 by this time,” said Brian Youngberg, an energy analyst with Edward Jones & Co. in St. Louis. “Right now, the market wants you to spend within your cash flow, no exceptions allowed. It’s just a response to that.”

The “modest tweaks” in this week’s second-quarter earnings reports will probably continue in the coming days, Youngberg said, as drillers focused on U.S. shale plays take center stage.

“Companies are going to be cautious,” he said. “No one wants to be the outlier.”

After surging above $55 a barrel in January, crude prices fell amid a persistent glut in global oil supplies. West Texas Intermediate crude, the U.S. benchmark, hasn’t topped $50 since May, although it inched closer to that level on Thursday after a report that U.S. stockpiles had plunged. WTI rose 29 cents to settle at $49.04 a barrel in New York.

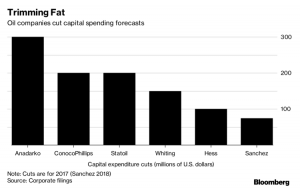

In earnings reports Thursday, Norwegian producer Statoil reduced its 2017 forecast for exploration spending by 13 percent, to $1.3 billion. Houston-based Conoco dropped its capital expenditure budget for the year by 4 percent to $4.8 billion, after announcing more than $16 billion in sales of what it considers lower-performing assets.

Hess announced a 4 percent cut the previous day, although it said it would still be able to boost annual oil production. The company said it was less certain of a plan to add two more drilling rigs to the four it has operating in the Bakken shale play in North Dakota.

Whiting Petroleum Corp., another Bakken driller, and Sanchez Energy Corp., which focuses on the Eagle Ford shale in Texas, also announced cuts. Earlier in the week, Anadarko Petroleum Corp. said its drilling budget would be $300 million less than originally thought, about a 6 percent reduction.

“We sincerely believe that the volatility of the current operating environment requires financial discipline,” Chief Executive Officer Al Walker told analysts on a July 25 conference call. “As I have said many times, pursuing growth without adequate returns is something we will avoid.”

While oil companies have generally beat analyst profit estimates for the quarter, reaping the benefits of three years of painful cost-cutting and efficiency gains, investors still appear unimpressed. The energy industry has been the worst performer in the MSCI World Index this year. Brent crude, the global benchmark, remains in a bear market.

It’s too early to say the industry discipline will lead to lower production, Goldman Sachs Group analyst Brian Singer, said in a research note Thursday. Anadarko’s capital budget, for one, has been affected by “unique” circumstances, including a decision to temporarily shut 3,000 wells after an explosion in Colorado.

Exxon Target

Exxon Mobil Corp. and Chevron Corp., the world’s first and third biggest oil producers by market value, will announce quarterly results Friday. Even if they don’t cut their budgets, they’re already on track to underspend 2017 targets. On an annualized basis, Exxon’s first-quarter capital expenditures were 24 percent lower than they needed to be to reach the full-year goal of $22 billion. At Chevron, the deficit was 11 percent.

Royal Dutch Shell Plc kept its capital budget steady at about $25 billion in an earnings report Thursday. Still, CEO Ben van Beurden said disciplined spending remains a priority.

“We are getting fit for the $40s with the way we are going,” he said, referring to oil prices. That way, the company can take advantage if prices rise to $60, Van Beurden said.

Recommended for you