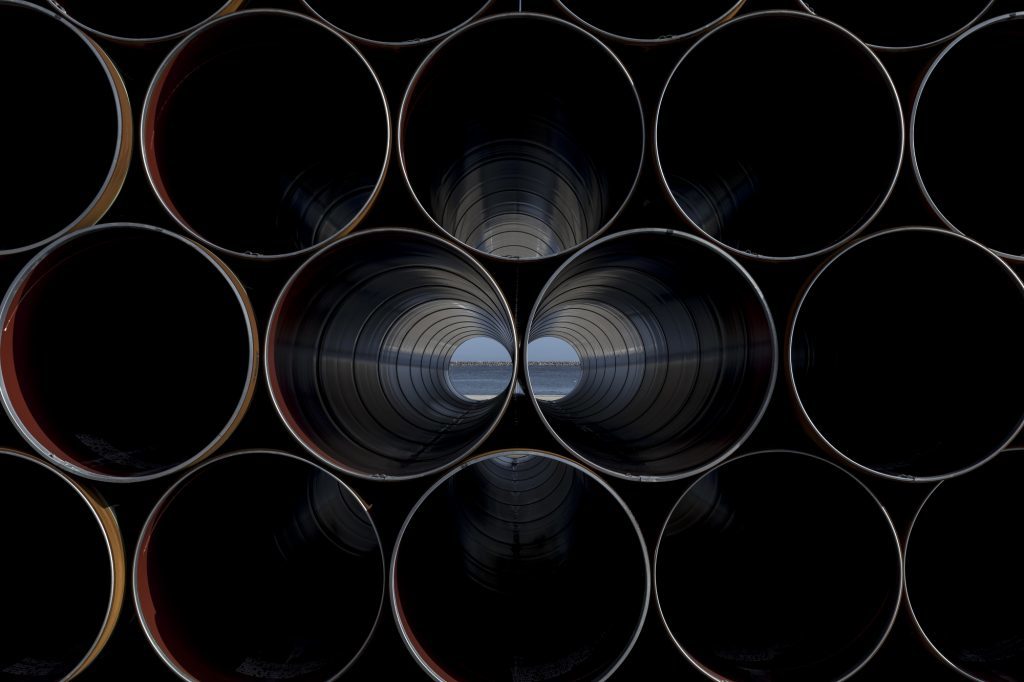

The value of natural gas pipelines is so high right now that even Southern Co., a company that’s spent billions to increase its stake in the business, couldn’t resist selling off two small systems to make more than $1 billion.

Southern said Monday in a statement that it agreed to sell Elizabethtown Gas and Elkton Gas to South Jersey Industries for an enterprise value of $1.7 billion. Shares of the buyer had their biggest decline in more than six years. “It’s an expensive acquisition,” said Chris Ellinghaus, a New York-based analyst for Williams Capital Group who rates South Jersey at hold. “Not a big surprise for local natural gas distribution companies right now.”

With electricity demand on the wane, utilities have been expanding into the gas pipeline business to bolster profits. The two gas distributors sold Monday were acquired by Southern as part of its $8 billion takeover of AGL Resources Inc. It followed that up with the purchase of a 50 percent stake in Kinder Morgan Inc.’s Southern Natural Gas pipeline system for $1.5 billion last year.

Once the deal closes, South Jersey said it will become the second-largest gas provider in New Jersey with more than 675,000 customers. The purchase price is $1.4 billion after taking into account tax benefits, the company said.

The acquisition “is a great fit,” South Jersey Chief Executive Officer Michael J. Renna said Monday in a separate statement . It “reinforces our commitment to high quality, regulated earnings growth,” he said.

Shares of South Jersey slumped 9.3 percent to $32 in New York. That was their biggest drop since August 2011.

The deal will strengthen Southern’s balance sheet by reducing existing financing requirements, Chief Executive Officer Tom Fanning said in the statement. The sale is expected to close next year.

“This makes sense geographically,” said Ryan Kelley, a manager of the $1.4 billion Hennessy Gas Utility Fund. The transaction “incrementally reduces debt at attractive valuations” for Southern.

Recommended for you