BP’s new Houston-based pipeline spinoff, BP Midstream Partners, commenced public trading on Thursday below its pricing expectations.

BP started trading at $18 per unit on the New York Stock Exchange, which is below the $19 to $21 range BP provided less than two weeks ago. The initial public offering is putting 42.5 million common units up for sale, meaning the IPO could generate $765 million.

British Big Oil giant BP will maintain more than a 53 percent ownership stake in the new spinoff.

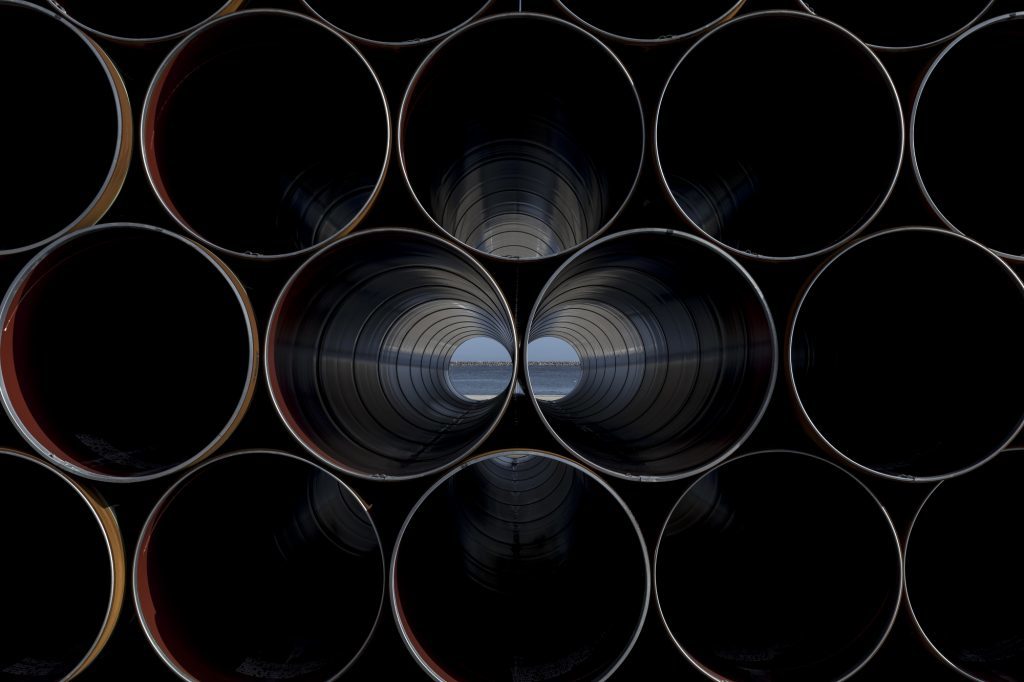

The goals are to raise more money, attract new investors, and boost the value to its pipeline assets. The midstream business primarily will house BP’s Gulf Coast and Midwest assets, specifically its Gulf of Mexico pipelines, processing and storage capacity connecting its deepwater Gulf platforms to Louisiana, as well as its pipelines and other assets with its Whiting refinery in Indiana.

The new business is trading under the “BPMP” stock ticker symbol. BP Midstream will have a Houston headquarters with additional offices in Chicago.

BP originally said in July it was considering turning its U.S. pipeline business into a publicly traded master-limited partnership, which is a uniquely American tax-avoiding corporate structure that requires the companies to distribute most of their income to investors in payments similar to stock dividends. MLPs are popular with pipeline companies.

Out of the so-called “Big Oil” companies, only Royal Dutch Shell already had an MLP, Shell Midstream Partners, which was spun off in 2014.

Robert “Rip” Zinsmeister is taking over as the new BP Midstream CEO after serving nearly six years as BP’s chief operating officer for mergers and acquisitions. The chief operating officer is Gerald Maret, who was president of BP Pipelines. And the chief financial officer is Craig Coburn, the former CFO for BP America.

This first appeared on the Houston Chronicle – an Energy Voice content partner. For more click here.

Recommended for you