Petrobras may be making progress in its plan to reduce debt, but a former shareholder in the state-controlled energy giant isn’t ready to jump back in quite yet.

Aberdeen Asset Management Plc, the Scottish emerging-markets investor that backed Petrobras for more than a decade, exited the bet in 2014 as the Brazilian oil producer dealt with the so-called Carwash graft probe. Since then, a new CEO is pushing a plan to reduce the debt load it carries with asset sales and partnerships.

Still, buying back into Petrobras now would be “a political gamble” with less than a year to go until a presidential election, according to Peter Taylor, the head of Brazilian equities at Aberdeen. “But in 18 months’ time maybe it becomes less so,” he said in an interview.

One key to the future will be who gets elected because Brazilian presidents have traditionally picked who runs the company, which the government controls with a majority of voting shares. While the pool of presidential hopefuls has no clear market-friendly front-runner, there have been at least two prominent figures in the run-up who have said they would push to privatize Petroleo Brasileiro SA, as the company is formally known.

Eliminating government meddling through privatization would be significant, Taylor said, though he believes the company will remain state owned for the foreseeable future.

“Petrobras was always the one that gave us more headaches because it wasn’t a nice clean play on oil — far from it,” Taylor said. “It was a play on Brazilian government policy.’

The attraction? “It had enviable assets,” he said.

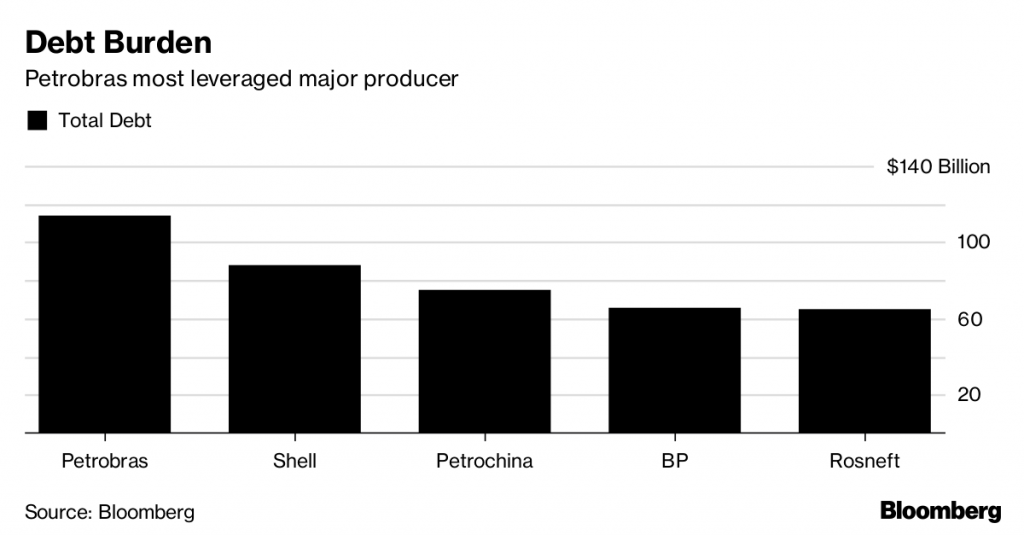

Regardless of the fate of the current chief executive officer, Pedro Parente, he may have provided a glimpse into what a more independent Petrobras might look like. The company recently spun off its fuel distribution network in the biggest initial public offering since 2013 as part of a drive to cut billions of dollars in debt.

Thanks largely to Parente’s efforts, many analysts are no longer as wary of Petrobras as Aberdeen, with the company counting seven buy recommendations versus only two in 2015, according to analysts tracked by Bloomberg. The expectation of about $10 billion in asset sales and some operational improvements are seen as positive drivers for the company in 2018, according to a recent note by UBS Group AG analysts Luiz Carvalho and Julia Ozenda.

Aberdeen this year was bought by Standard Life, a Scottish multiasset strategist, to form Standard Life Aberdeen, one of the U.K.’s largest investment managers.

For now, Taylor is hoping to capitalize on Brazil’s economic recovery by investing in sectors such as banking and retail. But he’s still watching Petrobras intently.

In the past, Aberdeen had to justify why it stayed with Petrobras, Taylor said. “We now have to justify why we don’t hold it.”

Recommended for you