U.K. utilities may have to delay or give up on building power stations as new generators won only a fraction of the capacity offered in a tender to provide backup electricity.

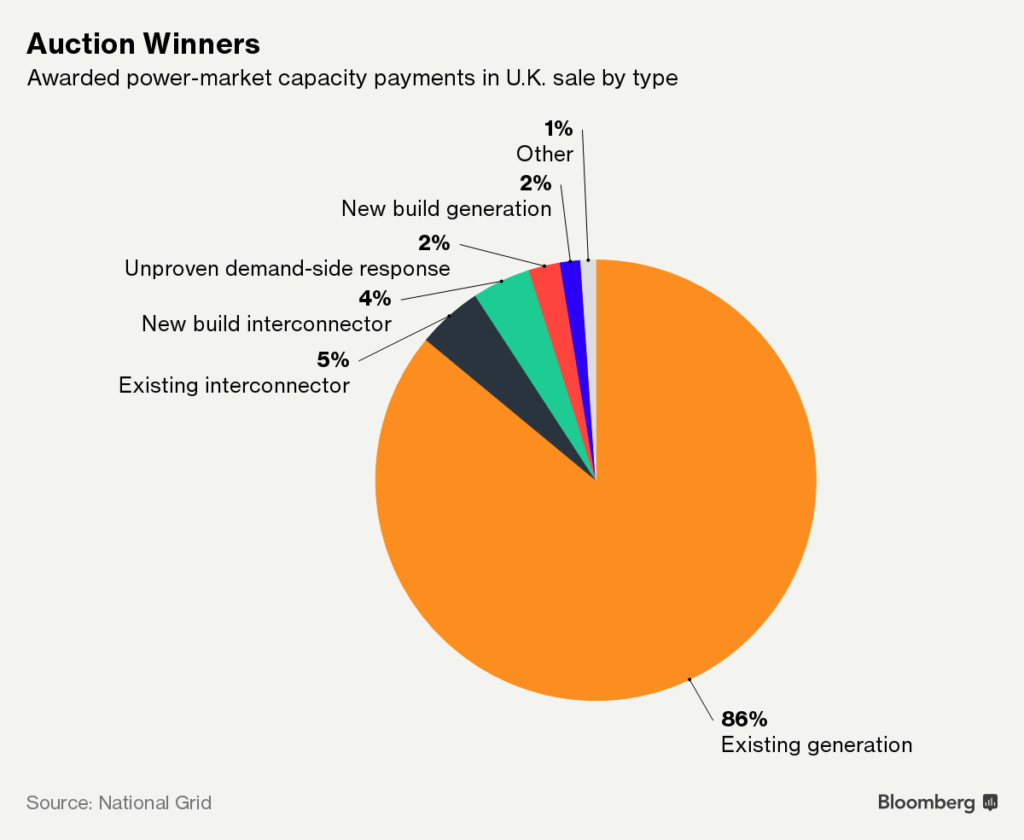

The auction process, set up to encourage new installations, only saw 1.5 percent of the total going to proposed plants. The lack of new projects could put pressure on Britain’s power supply at an uncertain time for the nation’s energy policy as it negotiates its exit from the European Union.

Britain has pledged to phase out coal generation by the middle of the next decade, but some plants could shut sooner. Without additional income from capacity contracts from 2021, it will be difficult for operators to run stations profitably, according to Bloomberg New Energy Finance.

“It’s very hard to see any new greenfield projects happening, it’s very very difficult especially at a low price,” said Andreas Gandolfo, an analyst at BNEF in London. “They would have to stretch their economic assumptions beyond what is economically reasonable, by a lot.”

The auction for 2021-22 delivery cleared at 8.40 pounds ($11.70) per kilowatt, which was as much as 12 pounds lower than analysts expected. BNEF forecast a clearing level of as much as 20.09 pounds.

To read more on Britain’s second gas dash, click here

So far, power prices at the auctions have been too low to encourage construction. Barclays Plc estimates that new gas stations, known as CCGTs, will need payments of as high as 28 pounds a kilowatt. RBC has said “very few” gas-fired plants are likely to proceed without government subsidies.

“Big gas plants are not needed to bridge the gap between coal and renewables, especially in the light of unprecedented falls in the cost of wind and solar power,” said Jonathan Marshall, energy analyst at the Energy and Climate Intelligence Unit.

While utility Drax Plc won the right to sell power from two existing coal units, it failed to win support for two gas plants. SSE Plc said 2,811 megawatts of capacity which prequalified for auction didn’t secure agreement, including for its Fiddler’s Ferry coal-fired power station.

RWE AG’s planned U.K. power stations also missed out in the auction. New-build sites at Grimsby B, Ferrybridge, Cheshire and Hythe didn’t secure an agreement but the German utility said it may consider them for future subsidy sales.

Coal Hole

A smaller auction last week already had one big victim. The U.K.’s oldest major coal-fired power plant Eggborough in Yorkshire said it will have to close after its last contract runs out in September.

The U.K. started the auctions in 2014 to avert power cuts as coal-fired stations shut and to encourage construction of new plants. Most of the awarded capacity at Thursday’s tender went to existing generation, at 86 percent.

Generating capacity totaling 75.1 gigawatts competed for 50.4 gigawatts of awarded contracts for the 12 months from October 2021. Winners will receive a steady payment on top of the electricity that they sell, but must produce even at times of system stress or face penalties.