Aberdeen-based oil and gas engineering business Plexus Holdings said yesterday that success had enabled it to increase its workforce in the past year by 25% to 74.

It said it had achieved strong sales and profit growth in its second year as an Aim-listed company.

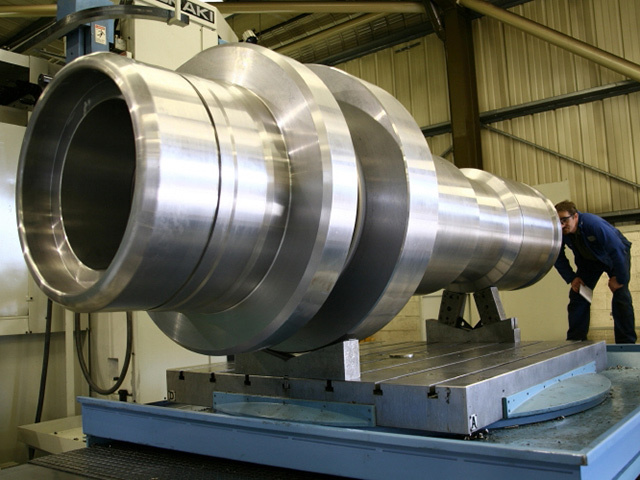

Chief executive Ben van Bilderbeek said: “It is particularly important to note that we have continued to advance our strategic goals of raising the profile of our proprietary POS-GRIP wellhead equipment.

“This has resulted in increasing interest and support from the global oil and gas industry, particularly in the high-pressure/high-temperature (HP/HT) rental wellhead exploration arena.”

He said this success had enabled it to win business from new customers, including its first contract with a Middle Eastern operator and its second extreme HP/HT contract, while it had also given Plexus the platform to establish its first base outside the UK, in Malaysia, allowing it to target the Asian marketplace. He added: “Our focus remains in rental wellhead equipment and as such we are looking to accelerate investment in our . . . inventory to increase capacity for servicing customer demand from around the world, and improve equipment utilisation rates.

“At the same time . . . we will continue to invest in developing our proprietary POS-GRIP technology for applications outside of wellheads.

“This has already enabled us to move into the subsea market. I am confident these initiatives and the unique nature of our technology will encourage potential licensees and partners to work with us not only in the exploration rental equipment arena but . . . in the key production wellhead sales market.”

Plexus reported pre-tax profits of £1.9million yesterday for the year to June 30, up 145% on the year before, when it made profits of £800,000 before an £800,000 gain on disposal of an investment.

The firm also posted a 29% increase in turnover to £13.3million. It added that it had made capital expenditure of £3.8million during the year, of which £2.4million was in property, plant and equipment, primarily reflecting growth in its rental inventory.

Broker Brewin Dolphin said Plexus’s strong organic growth and forecast-beating results had resulted in it giving the stock a price target of 70p and rating it as a “buy”. Shares closed yesterday down 3.37% at 43p.

Recommended for you