The Falkland Islands are poised to become a new centre for energy production after UK-listed Rockhopper Exploration said yesterday it was to invest £1.27billion in the area and would start pumping oil there in 2016.

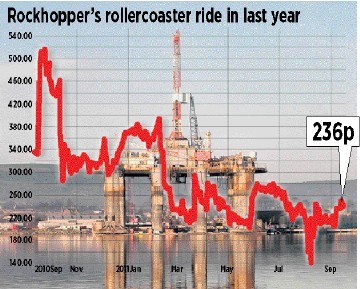

The firm, whose shares have been on a rollercoaster ride over the past year, ranging between £1.35 and £5.49, said output from its South Atlantic Sea Lion discovery would ramp up to a maximum of around 120,000 barrels of oil per day (bopd) by 2018. A leased floating production vessel is to be used.

The emergence of the UK-governed territory as an oil producer will likely stoke tensions with Argentina, which nearly 30 years ago fought a war against Britain for control over the islands over which it still claims sovereignty.

Argentina maintains that the islands, which are known as the Malvinas throughout South America, are occupied illegally.

Last year, Argentina said ships sailing from its ports to the Falklands would need a government permit – potentially complicating the prospects for development.

Friction resurfaced in June, when the UK Government refused to hold talks over the islands.

Aberdeen-based Diamond Offshore Drilling UK’s Ocean Guardian rig has been working for oil companies off the Falklands.

Rockhopper made its Sea Lion find two years ago, but analysts have since questioned whether there is sufficient viable oil to justify investment in infrastructure in the South Atlantic.

Salisbury-based Rockhopper said its reserves, which it estimated at around 350million barrels of recoverable oil, were large enough for a development.

The firm has spent recent months drilling a series of appraisal wells to establish the size of its Sea Lion find.

Despite the big investment announcement, Rockhopper’s shares fell more than 4% to just over 236p after having outperformed the European index of oil and gas companies by 14% over the past month.

The company, whose stock is traded on the alternative investment market, has not yet said how it will fund its spending plans. It currently has around £108million available, enough to pay for two more scheduled wells.

Analyst Richard Rose, at stockbroker Oriel Securities, said: “We would expect the financing of the development and potential farm-down pre-development to be a hot topic of conversation.”

It is thought Rockhopper could turn to another oil firm for help to fund the project, although some of the world’s largest oil companies have said in the past that the Falklands were unattractive.

A US diplomatic cable leaked last year quoted a senior executive at US company ExxonMobil as saying he believed resources in the islands were not sufficient to be profitable.

But positive drilling results also announced by Rockhopper yesterday could push its reserves higher, increasing the attractiveness of partnering with the company despite the political risk posed by the sovereignty issue.