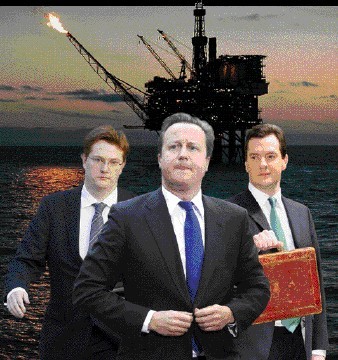

The UK Government’s £10billion tax raid on North Sea oil and gas firms has been branded “opportunistic” by a powerful group of MPs.

The Conservative-Liberal Democrat coalition at Westminster was also told the move was “not sensible” and may have “undermined investor confidence”.

The verdict was delivered by the Commons energy and climate change committee after it heard evidence that the Budget decision in March had left Britain among the “most unstable oil and gas provinces in the world”.

As well as urging ministers to rebuild industry confidence, the MPs raised other concerns about energy policy in a report published today.

They warned of a looming “dash for gas” as new plants are built before 2015 when a review could lead to tighter carbon emissions rules.

And they recommended that the energy industry fund the creation of an independent agency to manage the country’s strategic oil stocks.

Industry leaders were left aghast by Chancellor George Osborne’s surprise tax raid on producers – announced without consultation.

The committee criticised the move and said there was a clear need to sustain investor confidence by avoiding similar surprises in the future.

Relationship

“It is not sensible to make opportunistic raids on UKCS (UK Continental Shelf) producers,” the report said.

“The government must build a more constructive relationship if it is to restore industry confidence and maximise the benefits gained from the UKCS.”

Sir Robert Smith, committee member and Liberal Democrat MP for West Aberdeenshire and Kincardine, said: “This report calls on the government to work constructively with the industry to restore investor confidence after the Budget tax surprise.

“That confidence is crucial to ensuring we maximise jobs and income to the country from our oil and gas.”

“Oil and gas only brings benefits to the country if investors fund exploration and production.”

Angus MP Mike Weir, the SNP energy spokesman at Westminster, seized on the comments in the report, saying the tax raid had undermined investment and job creation in a “vital” industry.

“There is widespread opposition to the way the UK Government is treating the North Sea industry, and instead of simply regarding Scottish oil as a cash cow, the Tory-Lib Dem government must realise how important our offshore industry is for jobs across Scotland and for the economy of the north-east in particular.”

Labour’s shadow energy minister, MP Tom Greatrex, said: “The select committee’s report is scathing in its criticism of the Tory-led government’s attitude to the oil and gas industry.

“It was short-sighted of the government not to consult the industry on the changes to the fiscal regime in its Budget. Short-term political gain is no substitute for sustained long-term investment.”

The Department of Energy and Climate Change will be asked to respond to the committee’s report.

Industry body Oil and Gas UK gave evidence during the inquiry. Last night, the group’s economics director, Mike Tholen, said: “Oil and Gas UK welcomes the committee’s view that in order to maximise production from the UKCS, the long-term impacts of changes to the tax regime should be considered and that to restore industry confidence after the 2011 Budget and maximise the benefits gained from the UKCS, the government must build a more constructive relationship with the oil and gas sector.

“Energy investment, whether in production, refining or distribution, is by its nature long-term. Ensuring the maximum economic recovery of the UK’s oil and gas resources needs long-term thinking. We are pleased to say the government’s engagement with the sector since the Budget has been more encouraging.”

Important

Chief Treasury Secretary and Highland MP Danny Alexander was the architect of the scheme to plunder offshore industry profits to fund a cut in fuel duty.

A Treasury spokesman said: “The Treasury values the hugely important contribution of the oil and gas industry to the UK economy.

“Though we understand the concerns of the industry about tax changes made at the Budget, our priority had to be to help families and businesses at a time when high oil prices were putting pressure on motorists.

“We do not believe the changes will have a significant impact on investment, and indeed there have been a number of positive announcements on North Sea activity from companies such as BP, Statoil and Apache.”

Recommended for you