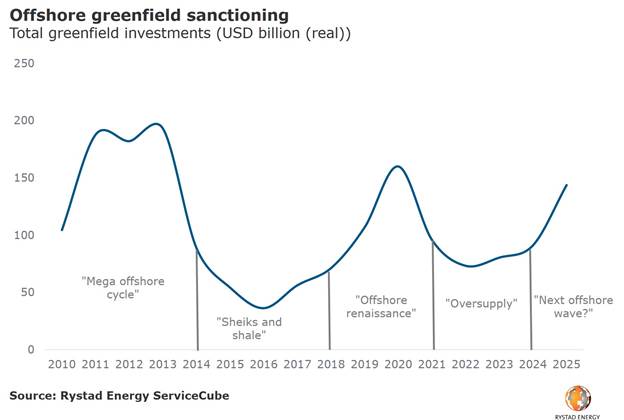

The sanctioning of oilfields is set to slow across the globe in the early 2020s, according to new research.

Independent energy research and consultancy firm Rystad Energy forecasts the service market will decelerate from 7% annual growth per year in 2019-2022 to 3% from 2022 to 2025.

Rystad predict this will see annual growth rate in the global offshore oilfield services market halve by 2022.

Audun Martinsen, head of Oilfield Service Research, said: “Just how things ultimately play out in the offshore market will depend to a large extent on whether OPEC, with help from Russia, will decide to take serious measures to stabilize the market over the next years.

“If the group decides to rein in production to protect commodity prices, momentum in the offshore market could continue.

“If not, the offshore renaissance party seems destined to come to an end in 2022.”

He added: “Higher oil prices were a primary cause of the recent upstream spending spree and – in keeping with the cyclical nature of this industry – the added production from those investments will soon help to put downward pressure on oil prices, which in turn will undermine field sanctioning activity post-2020.”

Rystad claim that with the oil and gas market currently experiencing a period of growth that “the tide seems likely to turn” as projects approved in 2018/19 start production.

It adds that four consecutive years of growth in the offshore industry will likely spur inflation in many service sectors, possibly reaching 10-15% from 2018 levels.

Mr Martinsen said: “The effect will be a noticeable slowdown of greenfield service purchases of platforms, subsea infrastructure, drilling rigs and vessels, causing the overall offshore service market growth rate to be cut in half.

“We estimate that investment commitments associated with offshore project sanctioning are likely to drop to between $70 billion and $80 billion per year – only half the amount forecast in 2020.

“Fewer projects sanctioned, as well as fewer completed from the ‘offshore renaissance period’ of 2018 through 2021, will likely cause the offshore service market to reach an inflection point in 2022.”

Recommended for you