AN ABERDEEN oil and gas consultancy has outlined a plan it thinks could help avoid the prospect of marginal fields being lost to future production.

ADIL has proposed bringing groups of acreage owners together to share facilities, which they would pay a tariff for and would be funded and built by an independent third party.

It says while larger projects like Clair Ridge and Golden Eagle are pressing ahead, many smaller prospects in the hands of independents could be stranded due to a predicted shrinkage of the available infrastructure, development costs and the lack of incentives for hub operators to take on third party business.

According to Jim Hannon of analysts Hannon Westwood, by 2020 many of the 107 oil and gas hubs in the North Sea will be near the end of their lives and without new production to sustain them, they will be removed, potentially leaving many fields stranded.

Worryingly, he said, despite there being 477 discoveries and 2,000 prospects in the UK North Sea, exploration and appraisal well spuds had fallen to their lowest in 45 years, partially a backlash of the March surprise tax grab.

He said Hannon Westwood estimates that by 2020 the hub infrastructure could shrink 50% and strand about 3billion barrels of unassigned oil.

He also said there are more operators in the North Sea, many with little equity to pay for new infrastructure.

“That to me is building up a problem,” said Mr Westwood. “You are creating a lot of new ownership and prospects but on the other hand not creating a solution of where it is going to go.

“We might feel comfortable with the hubs we have in place today, we might be able to access about every prospect in the North Sea. But it is all a bit risky.”

ADIL managing director James Paton said operators’ focus is on maintaining infrastructure and production issues rather than adding third party business.

Smaller exploration companies could have most of their equity tied up in one field, lack funding, need a guarantee of a host service through full field life, fear lack of control over operational spending and even host modification costs.

“No one is doing anything wrong,” he said. “It is just the perspectives and drivers are different. Companies want third party business but it is really hard without risking native production.”

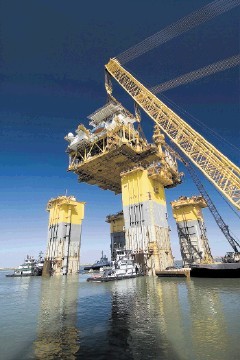

He said the model ADIL proposed had worked before, including the private-equity-funded Independence project in the Gulf of Mexico, where deep water fields owned by about five operators are serviced through one hub.

He also says the firm gained bank and private equity interest for a scheme in the southern North Sea, but that one operator backed out and it fell through.

“The idea could even help existing infrastructure where operators have issues with space or lack of power,” he said.

“I think something has to be done,” he added. “I believe this solution meets the issues but it will still need operators to enter in to a spirit of collaboration.”

And the alternative? Nationalise the infrastructure.