Growing optimism in the oil and gas sector has failed to date to deliver a lift in oilfield services (OFS) transactions, according to KPMG.

The firm said global geopolitical uncertainty was threatening to halt the current positive outlook, with evidence of activity already failing to meet expectations.

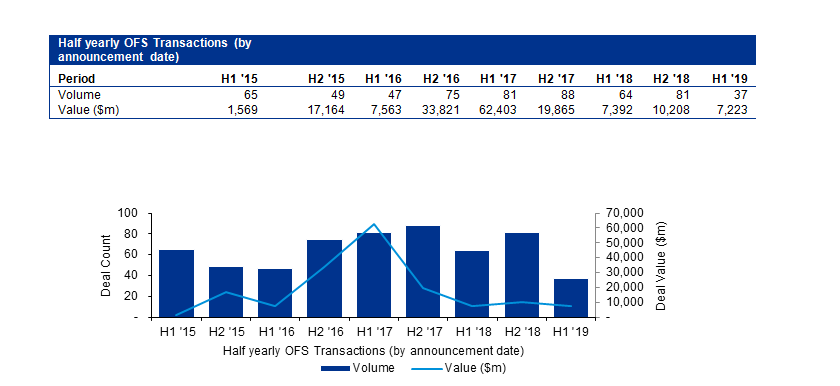

International data collated by KPMG shows the number of completed corporate global OFS deals in the first half of 2019 were at their lowest level since the 2014 downturn.

US land-focused service companies have been the main driver of activity in recent months and years, but North American activity has recently slowed, and there has been no material step up in European or international markets.

Alan Kennedy, oilfield services UK lead partner at KPMG, said: “To date, the expected uptick in OFS M&A is yet to manifest itself in actual, completed deals.

“This is in part due to diversification, investment and transactions in related industrial sectors, not captured by the statistics.

“However, fundamentally, I would attribute this to the earnings profile of many companies in the sector.

“Although they have survived the downturn and are rebuilding earnings, they have not done so yet to a level which supports pre-crash valuations, as operators continue to retain purchasing power.

“Vendors believe that earnings and hence valuations will continue to improve and so are reluctant to transact just yet, whereas buyers are still cautious and want to see more evidence of sustainable earnings growth”.

Recommended for you