Heavyweight oilfield service providers like Saipem and Baker Hughes are diversifying beyond oil and gas development projects and are moving increasingly into renewable energy projects, Rystad Energy finds.

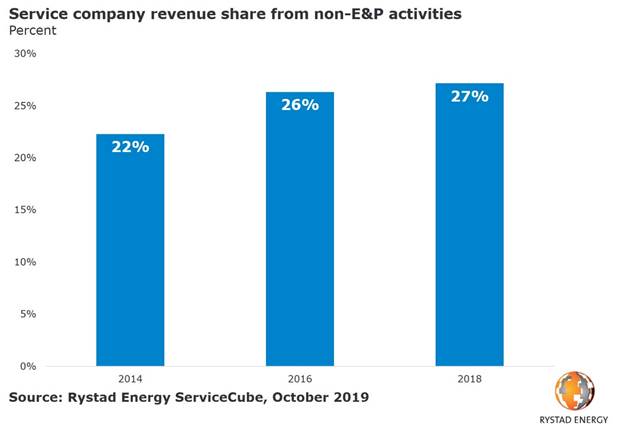

In 2014, non-upstream oil and gas activities accounted for 22% of revenues among service suppliers. This share grew to 27% in 2018. Rystad Energy, the independent energy knowledge house headquartered in Norway with offices across the globe, expects the trend to accelerate in the next decade.

“If pure-play contractors within drilling, well services and seismic – which don’t have much to offer outside the upstream oil and gas industry – are removed from the equation, activities outside of upstream accounted for nearly 30% of last year’s revenues,” says Audun Martinsen, head of oilfield services research at Rystad Energy.

This shift is driven by contractors seeking opportunities outside of exploration and development activities in oil and gas. It is also the result of large budget cuts in the upstream market, which have been greater than midstream market budget cuts, shifting the overall investment profile of the market space.

“But beyond these obvious motivators, the shift is also a sign of something greater – namely, the energy transition,” Martinsen remarked. “Suppliers have begun embarking on a journey towards becoming broader energy service companies, sailing away from the oilfield services segment that propelled them in the past.”

Baker Hughes is a notable example of this shift. After GE announced in September that it would reduce its ownership share from 50.4% to 38%, Baker Hughes rebranded itself earlier this month. Shedding its former persona as BHGE, a “fullstream company” focusing on reservoir to the refinery, the company will henceforth be known as Baker Hughes, an “energy technology company” that develops and deploys energy technologies to drive the industry towards energy transition.

Likewise, 50% of Saipem’s engineering and construction backlog was based on oil projects at the end of 2016. One of the largest EPC (engineering, procurement and construction) contractors and service conglomerates, the Italian company’s oil-based backlog had shrunk to just 33% by mid-2019, with gas and other energy projects assuming an increasing share of the portfolio. The firm expects clean energy to make up 60% of its portfolio going forward, as it takes on a larger presence in offshore wind, solar and geothermal power, as well as the conversion of biomass.

Saipem’s main competitor, TechnipFMC, has further steps down the road towards energy transition this year, initiating a plan to split the company and spin-off an entirely new entity to exclusively chase energy infrastructure projects.

“In the next decade, this trend is likely to crystallize further, with more oilfield service companies expanding into other energy services to adapt to the winds of change and to gain a first-mover advantage in the emerging clean energy service market,” Martinsen said.

Rystad Energy forecasts that the global upstream service market will decline in 2020 and grow only at a modest 3% for the four-year period from 2019 to 2022.

“For service companies, it will be a more lucrative journey to get exposed to a fast-moving energy market, like in Asia-Pacific, where renewable capex will overtake upstream investments as soon as next year,” Martinsen remarked.

Recommended for you