As with all commodities, the impact of the novel coronavirus (2019-nCoV) on Chinese gas demand will depend on both the severity and length of time required to contain the outbreak.

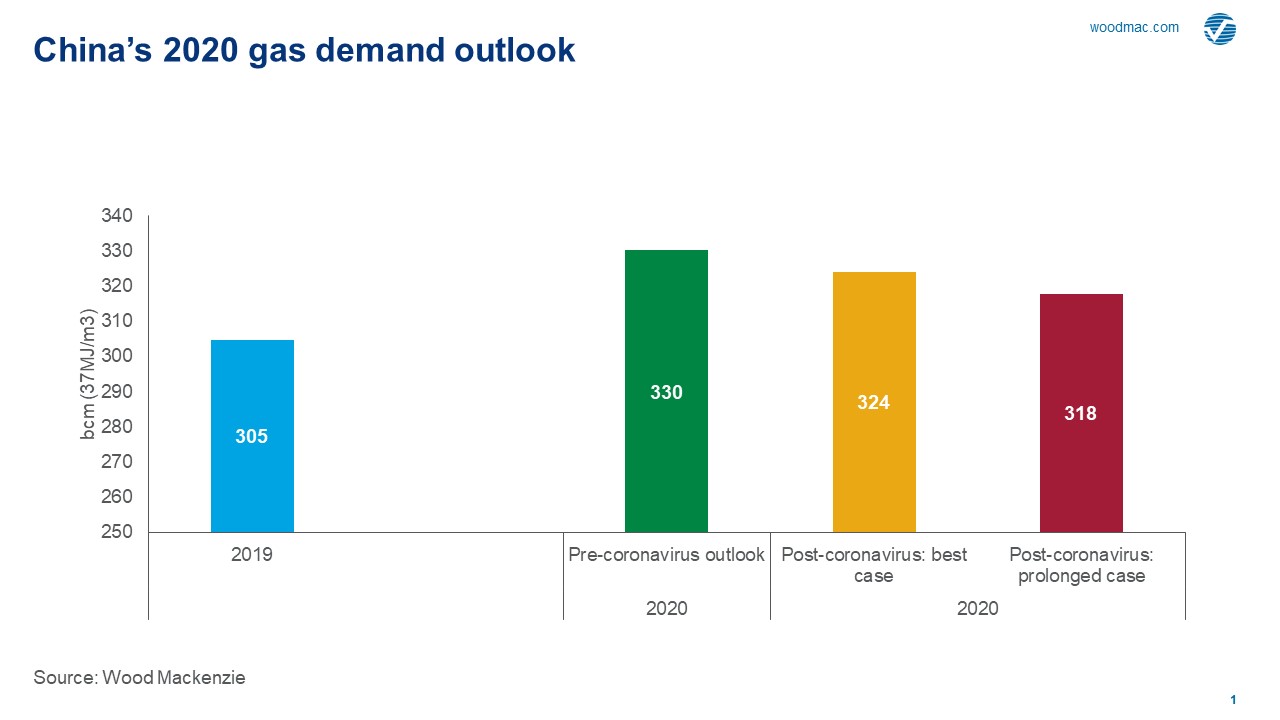

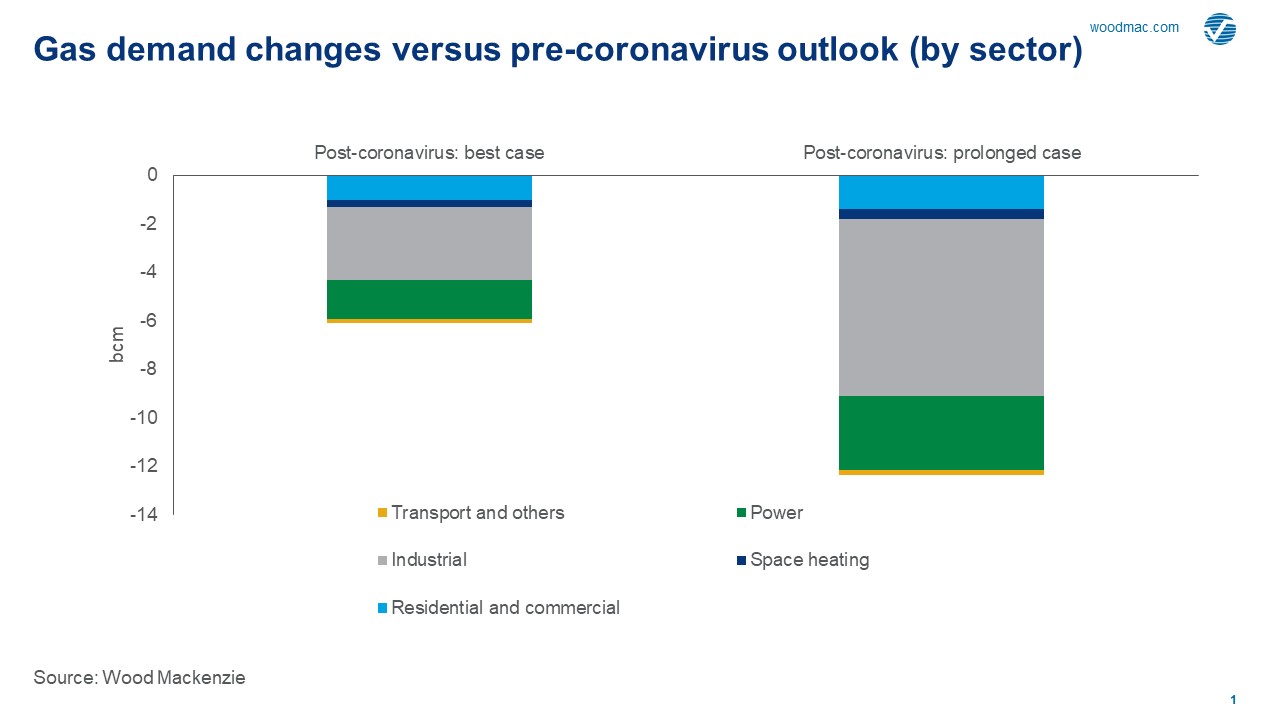

We estimate gas demand loss in China had reached 2 billion cubic metres (bcm) by the end of the first week in February, with more than half of this loss concentrated in the industrial sector. Though many international airlines have suspended travel to and from China through March and April, we expect domestic flights to resume in February. With a resumption in economic activity, although limited, we estimate a full-year gas demand reduction of between 6 bcm and 14 bcm in 2020, depending on the length of time required to contain the outbreak. Year-on-year growth rates drop to 6% and 4%, respectively, mostly as a result of Q1 downgrade, as compared to pre-coronavirus outlook’s 8%.

Domestic upstream gas production is affected by preventive measures to control the 2019-nCoV and travel restrictions have reduced manpower onsite. However, as baseload pipeline gas can be delivered in closed-off (i.e with limited manpower) operations, it is less affected. We have forecast domestic supply to be lower by between 1.6 bcm and 2.9 bcm.

LNG will bear the brunt of this reduction in domestic gas demand, although some disruption to domestic gas supply is also expected due to travel restrictions and reduced operations. We currently estimate the downside impact to Chinese LNG demand as between 2.6 million tonnes (Mt) ‘best case’ with recovery by April and 6.3 Mt in a more ‘prolonged case’ with a slower return to normal.

An over-supplied global LNG market prepares for the worst

The coronavirus outbreak and its impact on Chinese gas demand could not have come at a worse time for the already oversupplied global LNG market. Disappointing APAC demand growth contributed to the halving of LNG prices through 2019, and with further new volumes emerging from US producers, we were already anticipating lower prices through 2020. Prior to the coronavirus, we had expected the Pacific market to absorb 19 Mt of the approximately 27 Mt of new supply growth in 2020. This assessment was based on the view that Pacific demand growth would rebound significantly from last year. However warm weather through December and January in northern Asia has already put pressure on inventory levels in China, South Korea, and Japan and further weakening an already soft North Asian spot market.

With too much LNG, and nowhere left to place it, it looks like a supply correction is needed to balance the market. We are expecting supply response in some markets like Egypt and potentially in Eastern Australia, where the likes of Shell and APLNG could attempt to sell gas into the domestic Queensland gas market. However, it is US Gulf producers who have the highest marginal cost of supply and the most flexibility.

LNG contracts under force majeure

The Chinese government said it would offer support for companies seeking to declare force majeure on international contracts. The first such reported notes were sent by CNOOC last week to LNG suppliers, and CNPC and Sinopec could follow suit.

Entering force majeure is rare in LNG markets and will be contractually complex. Contract wording will need to explicitly include epidemics as force majeure events. Demand reduction on its own or a notice by a relevant Chinese government authority will likely be insufficient. In addition, prior to being released from their obligations to receive a cargo, buyers would need to follow contract procedures, proving that actions have been taken to minimise and overcome the impact of the force majeure event.

Total contracted volume into China in 2020 is 54 million tonnes per annum, still less than the two annual demand scenarios presented in our ‘best case’ and ‘prolonged case’. So, while major Chinese buyers may call for force majeure, suppliers may instead insist on trying to defer deliveries to later in the year once the demand impact of coronavirus has diminished.

Given the wide spread between high contracted prices and low spot market prices expected to persist through 2020, there is a strong commercial incentive for each side to resist the actions of the other. If buyers do succeed in exercising force majeure, the revenue impact on sellers could be significant. The approximate price for many of these oil-indexed contracts is around 14.5% of oil range, equating to US$8.83 per million British thermal units (Mmbtu) (using US$54 per barrel of oil equivalent); this compares with spot prices of around US$3.15/MMBtu.

Recommended for you