More than a million oilfield services (OFS) jobs globally “will likely be cut” as the industry grapples with the oil price war and the effects of the coronavirus, according to Rystad Energy.

The consultancy said a total of five million people are employed in the OFS market and contractors will look to scale down their workforce by at least 21% this year alone.

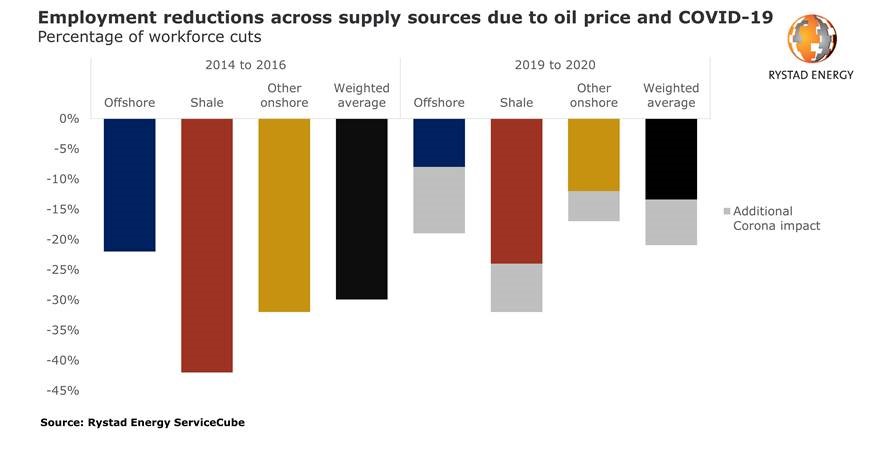

Unlike the downturn in 2015 and 2016, when the sector’s workforce was cut by nearly 30% from 2014 levels due to another oil supply battle, the industry now faces the additional effect of a “big decline in demand” caused by Covid-19.

The largest reductions will be in US shale, while the overall offshore segment is expected to be cut by 19% in 2020, as low oil prices halt most of the exploration and maintenance and operations (MMO) work for fear of a coronavirus outbreak on an offshore installation.

Meanwhile other onshore roles are expected to be cut by 17%.

Audun Martinsen, head of Oilfield Service Research, said: “Exploration and Production operators and contractors want to minimise the potential spread of Covid-19 by reducing the workforce to an absolute minimal level.

“This is happening across the world but Europe, currently, is the most impacted market.”

It comes as Rystad last week predicted 200 OFS firms in the UK and Norway are expected to go bust due to the oil price plummet, while union RMT warned there is potential for tens of thousands of UK jobs to be lost.

The union joined calls form trade body Oil and Gas UK for a package of support from the Westminster.

Low oil prices are likely to persist in 2021, Rystad said, meaning further workforce reductions could follow.

However, things may pick back up beyond that, Mr Martinsen added.

He said: “As we move into the second half of 2021, with better market fundamentals and a fading Covid-19, recruitment is likely to pick up in the shale sector and from 2022 will also kick-off in the offshore sector.”