Six months on from the passage of the IMO 2020 initiative – the International Maritime Organisation ruling that required the marine sector to reduce sulphur emissions by over 80% – how has the market responded to the new position, asks Andy Laven, COO of Sahara Energy Resources DMCC

Back in 2016 I gave a presentation at an industry conference where I asked the audience whether the IMO would delay the implementation of a point 0.5% sulphur cap for marine fuels from 2020. The results were clear – the vast majority expected a delay.

Much of the discussion at the time related to increased costs, lack of availability and fuel quality issues, so the response was not surprising. My view was that the decision was political and that, given the environmental context, it would be impossible to delay. Following the ratification of the decision, most articles focused on the challenges and problems that the change would cause.

The transition to a new fuel specification was expected to be slow. There was a feeling that marine gasoil (MGO) would come to the fore and that there would be a significant oversupply of 0.5% high sulphur fuel oil (HSFO). Distillate prices would increase and HSFO prices would collapse, with many also expecting there would be a significant number of quality issues with incompatible fuels and poor control in the supply chain. But what really happened?

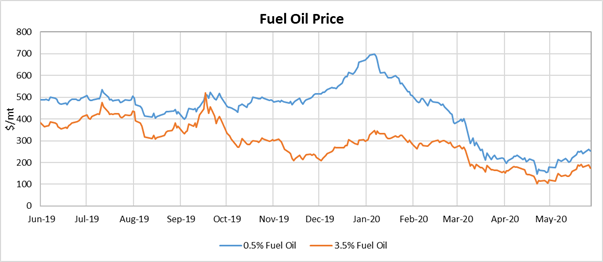

The graph shows the price of HSFO and 0.5% low sulphur fuel oil (VLSFO). From January 1, 2020, the former can only be used by a vessel that has an exhaust gas cleaning system, generally known as a scrubber. Two things are worthy of note. In mid-September 2019 the price of HSFO was briefly higher than VLSFO, and the peak difference in price was shortly after January 1, 2020.

While the talk was negative, the industry proved very capable of rebalancing and the shift to VLSFO started during the third quarter of 2019. The spike in HSFO was driven by restricted availability as storage shifted to VLSFO. The price of VLSFO rose, at times to higher than the next alternative, MGO. As the supply chain became more robust and stocks of VLSFO built up, the differential to HSFO dropped.

On occasions, HSFO actually became more difficult to purchase than VLSFO.

Virtually no-one switched to MGO. The early transition to VLSFO provided suppliers with time to shift their supply chain over to the new fuel. Refiners proved very adept at re-routing their streams and producing VLSFO. Proactive suppliers like Sahara Group were able to source and blend fuel oil to the new requirements.

The most dramatic change was that the demand for HSFO collapsed, but so did the supply. As a result, the prices for HSFO have remained remarkably stable, despite the changes. In March, oil prices fell, owing to the impact of COVID-19 and oversupply, having an impact on fuel prices. Despite this, HSFO prices remained stronger than VLSFO.

Quality hasn’t really been a problem either. The main two supply issues have been the level of sulphur and fuel stability. Additionally, there have been more reports of engine wear – as the sulphur acts as a lubricant, operators need to change their engine oils. So, where do we go now with marine fuels?

It has been a long six months since January 2020. There is no question now that the impact of the pandemic is likely to have a bigger effect on the marine business than even the most cynical projections around IMO 2020 would consider. The oil industry had quickly moved past the switch to a lower sulphur fuel, but COVID-19 has driven a level of economic disruption that will be much longer lasting.

Ongoing weakness in the shipping industry has significantly reduced liquidity and the availability of credit, which is the life blood of bunker supply. Although lower prices may be with us for a while, access to credit means that larger, well capitalised companies are likely to be the winners, both in the shipping and fuel supply.

As the global lockdown eases and economies awake, the shipping business will inevitably see increased demand. International shipping is responsible for around 90% of world trade. This will drive demand for VLSFO and prices should strengthen. The build-up of stocks in advance of 2020 meant shortages did not occur and the reduction in demand through COVID-19 meant the supply chain hasn’t been fully tested.

Demand will return to previous levels, probably during 2021, and this is why Sahara Group, propelled by its commitment to promoting cleaner fuels and protecting the environment is planning to expand its supply of VLSFO with the construction of a processing unit in Fujairah.

For the foreseeable future this will be the marine fuel of choice and we want to play our part in ensuring availability and supporting the supply chain that is necessary to keep trade moving.