Believe the numbers and Europe possesses around 1,780trillion cu.ft of “unconventional” gas of which 145TCF may be recoverable, according to Centrica.

Most of that gas is shale and coal-bed methane. Only a small proportion is classed as tight gas and most of that resource is thought to lie in the UK sector . . . an estimated 4TCF in new developments plus substantial quantities lodged in currently producing fields.

Centrica has suggested, given that some of the tight gas reserves are part of existing acreages, these are expected to come onstream fairly quickly; typically new developments are expected to come onstream within the next 1-3 years. That was back in 2010.

However, UK chancellor George Osbourne probably derailed most such plans in the March 2010 budget as a result of imposing an extra 12% layer of Corporation Tax on the North Sea and failing to recognise that oil and gas are not the same and must be treated differently.

It happens that perhaps half of the 4TCF new reserves resource lies in one North Sea field that was discovered back in 1988 (well 44/12-1), appraised (one well) in 1989 but later relinquished.

It was not appraised further until 2006 and again in 2009-10.

These wells were drilled by today’s operator GDF Suez, originally with Venture Production as its junior partner, though the latter was acquired in 2009 by Centrica in a deal worth £1.3billion.

The Carboniferous/Leman sands Cygnus field located beneath just 22m (76ft) of water, is now under development by GDF Suez with Bayerne and Centrica.

There are various estimates out there including that there could be 2TCF of recoverable reserves at Cygnus and perhaps more.

Assuming successful development and successful initiation of production, the likelihood is that the recoverable reserves estimate will be revised upwards.

Regardless of whatever the real resource figure turns out to be, Cygnus is under development based on a phased plan that allows for up to six platforms and 16 phase-1 production wells.

Amec secured the FEED (front-end engineering and design) contract in October last year.

The overall capex for Cygnus is unclear. However, according to Centrica, typical tight gas well costs will be in the order of £30-40million versus £10million for a conventional production well.

This is because long horizontal well sections and hydraulic fracturing are required to maximise the output from each well. These are the biggest cost drivers for tight gas wells.

The field development plan for Cygnus phase-1 was sanctioned by the Department of Energy and Climate Change (DECC) in 2009. Production is expected to start in 2013, exporting via a 27km pipeline to the Murdoch field and thence ashore.

Cygnus straddles UK North Sea blocks 44/12a and 44/11a. The gas is trapped in both Leman and Carboniferous reservoirs with up to five potential productive fault blocks.

Current stakeholders are operator GDF Suez with a 38.75% stake; Centrica has 48.75% and Bayerngas holds the remaining 12.5%. Bayerngas acquired its interest from Endeavour in August 2010.

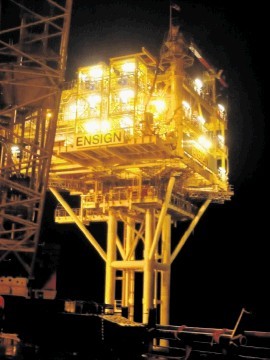

Centrica has further North Sea tight gas projects on its books including Ensign, which was due onstream late last year but is now scheduled to start up in the next few weeks. Ketex and Arrol are suspended as a result of last year’s North Sea tax hike.