Offshore drilling firms should re-think the “primitive” day-rate business model in order to survive the current industry crisis, according to new analysis from Boston Consulting Group (BCG).

Changing the historic business model, which “has never really evolved”, is among the measures suggested by the research firm, along with significant fleet rationalisation and efficiency improvements across areas including staffing and maintenance.

Drillers’ “dreadful performance” since the last downturn, and the “missed opportunity” for strong change post-2014, has them “ill-prepared” to handle the current crisis, BCG said.

Their plight is reflected by several companies entering Chapter 11 bankruptcy in the US, and with the Cromarty Firth in the North of Scotland filling up with idle rigs in recent months due to a lack of work.

Day rates – the cost of hiring out a rig – has been an “extremely lucrative” scheme in the boom days, rewarding drillers purely for asset ownership.

However, BCG’s “three-pronged plan of attack” for these companies includes accepting that this model “no longer fits today’s reality”.

“Drillers need to accept this, rethink their value proposition, and adopt a new model”, it said.

As it stands, drillers bear limited risk for the success of their activities, and BCG suggests considering offering “risk-based integrated drilling services and additional well-drilling and completion services” to amend this.

Additional services might include decommissioning and well intervention services, not as one-offs but a “core” part of their offering to exploit new revenue sources, which are increasingly sought after by operators.

This would “add genuine value through the assumption of well or performance risk”, along with alliances with other firms and a multi-skilled rig crew.

Repeating the mere restructuring actions of 2014 will leave the sector “far short of what’s needed to avoid sliding toward sunset industry status”, BCG said.

Boards will no longer accept a “wait and see approach” as they did six years ago, which reflected management’s “optimism that the crisis was temporary”.

BCG said many companies are still operating “inefficiently on multiple fronts” and are paying the price of that optimism, with still too many vessels for too little work.

They said Tier 2 or Tier 3 floaters should be scrapped after they come off contract, and they can envision a scenario “in which the industry’s total floater capacity is roughly half of what it is today”, controlled by two or three major players.

As of the end of August, around 45% of offshore rigs globally were idle, stacked or among the 65 new-builds, BCG said.

The analysis, which looks at the global market on a longer-term basis, comes following research from Bassoe Offshore last month suggesting a pick-up in the market for the UK sector in 2021 as it catches up on deferrals.

However, as BCG states, drillers have failed to make good returns long before the Covid-crisis and have had poor performance since 2014.

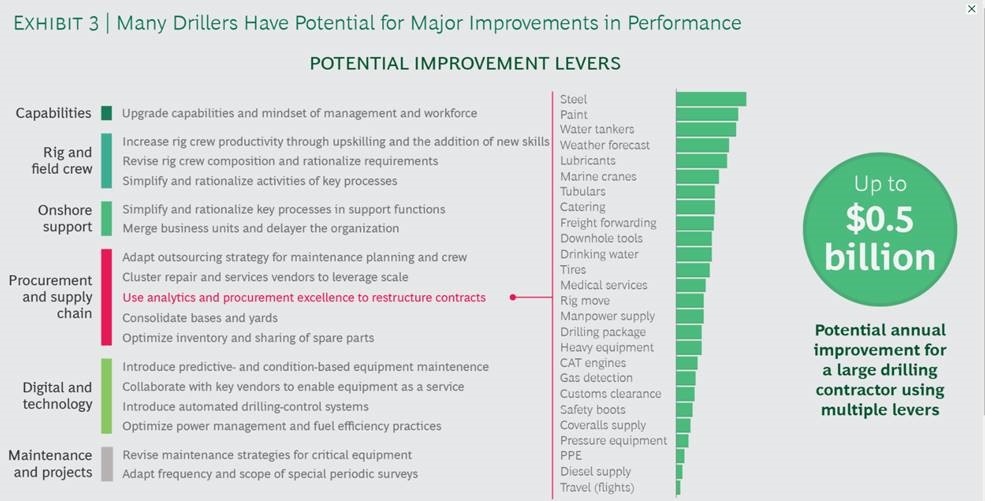

Meanwhile increasing productivity both offshore and onshore and embracing the right technologies will also be important.

At present, some companies have twice as many onshore support staff as needed BCG said.

It added: “The near-term path for most offshore drillers is rocky at best, and the days of outsized margins are likely gone forever.

“But by rethinking their business and being willing and able to make bold moves now, leading players can position themselves for healthy returns when the market finally stabilizes.”

© BCG

© BCG