Centrica highlighted buoyancy in its upstream oil and gas business yesterday, but consumers could face higher fuel bills after it also warned of rising costs.

The Scottish Gas owner – the UK’s biggest energy supplier – said recent upstream acquisitions should add around 11million barrels of oil equivalent (boe) to output in 2012.

Centrica acquired a package of Norwegian assets from Statoil and an additional stake in Norway’s Statfjord field from ConocoPhillips, adding 153million boe of reserves for total of £1.1billion.

In a trading update yesterday, the firm said it also expected to complete the purchase of North Sea assets from France’s Total over the coming months.

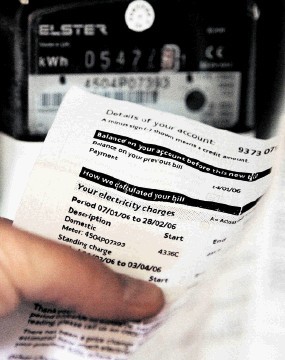

Centrica’s warning that retail energy costs are rising, with wholesale gas prices 15% higher for next winter and other costs expected to add £50 to the cost of supplying the average household this year, has fuelled fears of higher gas and electricity bills.

“Consumers will need clear evidence that price rises are warranted if they are to stomach further increases to their bills,” said Audrey Gallacher, director of energy at Consumer Focus. She added: “People simply don’t know whether what they are asked to pay is fair – the perception is that suppliers are quick to pass on high price rises and slow to pass on small price cuts.

“Much greater transparency on costs, pricing and profits is needed for customers to know whether they’re getting a fair deal.”

Price cuts by the UK’s major energy suppliers earlier this year were not enough to offset previous increases. Centrica dropped its standard electricity tariff by 5% in January after big rises in both gas and electricity bills last summer.

Environmental campaign group Greenpeace has recently turned its attention to “rip-off” energy bills, saying figures from industry regulator Ofgem show the cost of heat and electricity rose by 12.8% during the year to March 2012.

Recommended for you