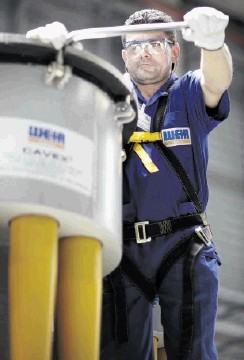

Scottish engineering company Weir Group reported rising turnover and profits yesterday, despite a “challenging” oil and gas market.

The firm said growth in its minerals and power and industrial divisions had offset a dip in orders for its oil and gas arm in the first half of the year.

The Glasgow-based business said it expected full-year results to be up on 2011, but the scale of the improvement depended on better conditions in the oil and gas upstream pressure-pumping market.

Weir reported turnover of £1.3billion in the six months to June 29, up from £1billion in the same period last year. Operating profits jumped 29% to £248million, while the pre-tax figure was up by 27% to £226million.

In the oil and gas division, turnover increased by 49% to £492million and operating profits jumped 46% to £123million, but order input was down 7% to £373million.

Chief executive Keith Cochrane said: “These results bear out the strength of our well-diversified group. Effective execution of our growth strategy in minerals and power and industrial and a good first contribution from acquisitions have offset the challenging pressure-pumping market conditions faced by oil and gas.”

Mr Cochrane added that he expected full-year pre-tax profits to come in at £440-£460million, compared with £396million in 2011.

The CEO said the final figure was dependent on a recovery in the oil and gas market. He added: “In the second half, we anticipate a strong performance from the mineral and power and industrial divisions and some improvement in oil and gas upstream pressure-pumping after market demand relative to the second quarter, although the timing of any improvement remains uncertain.”

Weir employs about 14,000 people worldwide, and in addition to its Glasgow headquarters also has Scottish bases at Alloa and in Aberdeen.

Weir shares closed down 2.9% at £16.55.

Meanwhile, UK engineering business GKN defied “increasing headwinds” in European car markets by lifting its dividend by 20%.

The firm, which makes driveshafts for almost half of all new cars, said the move reflected its strong performance and confidence in the future.

It forecast another “good year of progress” in 2012 after figures for the first half showed a 19% rise in pre-tax profits to £266million.

Chief executive Nigel Stein flagged the impact of economic conditions on European car markets and said that while overall vehicle production was likely to be lower in the second half it will still be 5% higher across 2012.

GKN, which increased its interim dividend to 2.4p a share, gave a major boost to its aerospace components division earlier this month when it signed a deal to acquire Volvo’s aircraft business. GKN’s aerospace arm increased trading profits by 8% to £86million, while the half-year surplus in the automotive business increased by 29% to £121million.