GDF, much like its Cygnus development, has been something of a sleeping giant in the North Sea.

The French-owned firm, known by most as a utility, has been building its expertise in the basin for at least 13 years, since joining what was then ELF on the then ground-breaking, high-pressure, high-temperature Elgin Franklin developments.

It is now a partner in projects like BG Group’s Jackdaw, the highest pressure/temperature field yet drilled in the North Sea.

Cygnus, first drilled in 1988/9 by Marathon Oil and thought to be sub-commercial, took its time to show its potential.

The field, so far thought to be 25km wide and 350ft deep, will be GDF’s North Sea game-changer when it comes online in 2015, albeit a year later than first anticipated, bringing with it much of the 10million of oil equivalent (boe) a year of production GDF Suez E&P UK’s managing director hopes to have notched up by 2016.

It is estimated to hold 720 bcf of 2P reserves with upside potential nearby and in surrounding acreage to the north and south.

Andy Spencer, subsurface manager at GDF, is the mind behind the field, described as the largest discovery in the southern gas basin in 25 years.

Having been dropped by Marathon as too small and potentially tight, Spencer re-assessed the Rotliegend and Carboniferous acreage after working for Atlantic Richfield on producing fields in the Dutch sector.

“I was looking at Dutch sector producers in block K3 and they looked very similar – I thought ‘what’s the difference’,” he said.

GDF picked up the licence in 2002 and drilled five appraisal wells, during which time the development concept altered considerably.

“It started as a small concept going to CMS (the Caister Murdoch System) for export and compression,” said Spencer.

“We had prolonged negotiations and kept appraising the field. It got to a point where we said ‘hang on, we have a different project here’.”

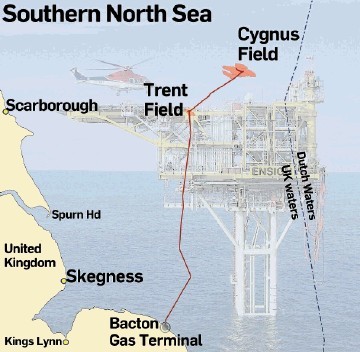

GDF’s latest plan, which it is hoped will be approved by DECC this summer, is for a main hub, with three 3-4,000 tonne-each bridge-linked platforms providing supporting accommodation, processing and export to the Esmond Transport System into Bacton, and a separate well head platform. Compression facilities will be able to handle 250million st cu ft per day on two compression trains.

It has not been an easy process – rising costs, in some areas 20-30%, have meant a tight grip has had to be kept on budgets and as a result delays have pushed first gas back a year, to 2015.

Spence says while the wells themselves are not technically challenging, the project has had to address shallow water depths of 16-20 metres, bringing strong currents and shifting tides. The aerial extend of the field has also added to the challenge.

Despite this, GDF is confident there is more to come from Cygnus, in which utility Centrica is a significant partner.

Initial plans are for 10 wells but the facility is being built with capacity for 20 wells, said Spence. Exploration drilling is due to continue on the field, with a well planned using the Ensco 80 next year.

Prospects to the south include Humphrey and Copernicus – following a naming convention of inventors.

Cygnus, coming on stream in 2015 following the firm’s two-well Juliet subsea development due on in 2013, will help GDF Suez boost production significantly by 2016 in the North Sea, says managing director Jean-Claude Perdigues.

GDF’s current production in the North Sea is currently about 2million boe a year, mostly gas, through a non-operated interest in the CMS system (Caister Murdoch System) operated by ConocoPhillips.

“We expect by 2016 in the first full year of Cygnus operating, production to be around or a little lower than 10million barrels of oil equivalent, five times more than what we are at the moment,” said Perdigues.

“It is going to be transformational for us, the development of Juliet and then Cygnus.”

There is also plenty more in the pipeline for GDF. It is working up to concept select on its central North Sea Jacqui discovery, which sits near the non-operated Josephine discovery. First gas on Orca, an unmanned installation development, to be exported via GDF Suez E&P Nederlands’ D15 platform in the southern North Sea, has been predicted for 2014.

It also has a busy programme ahead, including Josephine, operated by Talisman, and Taggart in the central North Sea later this year, Dalziel and Marconi in 2013, and “hopefully” one in the Juliet area.

With partner and operator Dong, it will also be taking part in drilling West of Shetland, on the Glenrothes and Craggonmore prospects, “probably in 2014”.

It is also bidding for acreage in the 27th round, “across the piece”, including West of Shetland.