Forty years ago this month the race was on to get first oil from the North Sea.

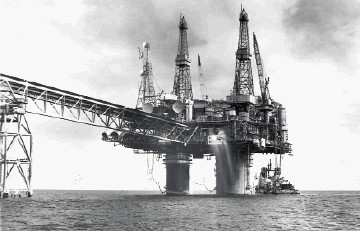

While the Beryl field was not the first past the winning post, it has not been a field shy of marking its marks – from being the first Condeep concrete platform in the North Sea to pioneering subsea development.

Now, in its 36th year of production, with more than 157 wells drilled to date (not including sidetracks), the field is about to make its mark yet again.

Just months after taking over Mobil North Sea from ExxonMobil, Apache North Sea has said it thinks there is enough oil in what it calls the east flank of Beryl to warrant a new platform in the field.

“We are seeing a lot of things and the more we learn the more we like it,” says Jim House, regional VP and managing director of Apache North Sea.

“There are a lot of ideas here and we are not competing for funding or having to get across certain risk thresholds.”

Beryl East Flank is a formation already produced, but not significantly. Apache thinks it could contain 40-50million barrels of oil and require a 10-15 well programme, and House thinks there could be more of the same out there.

“It is likely to require a new platform and will require water injection because it is partially depleted,” says House.

The challenge is that Beryl Bravo, which could feasibly have produced East Flank, is running out of well slots.

“We are likely to run out of slots on Beryl Bravo (which has 21 slots) in a year and a half,” he says.

Beryl Bravo is already busy and proving its worth. A deviated extension well drilled from it, B72, achieved higher initial flow rates than any well drilled on Beryl since 2001 – it had found an area with virgin pressure which had previously thought to have already been tested.

“We have just completed B73 and it looks everything as good as 72,” says House.

Beryl is a highly faulted complex geological trap structure, he says. But with that comes opportunities – “that’s the romance of drilling a complicated reservoir,” says House.

A big opportunity on Beryl was that 3D seismic had not been shot since 1997. Even then, data from 1991 was mostly being used due to processing issues on the 1997 data set, according to House.

Apache reprocessed some during purchasing negotiations and through that the firm was able to identify 4D traits, by comparing data sets, showing movement through the reservoir.

In August, the firm then ordered a three-month seismic shoot of over 15,000sq km using broadband technology over the Greater Beryl area, with a view to having the geological model fully rebuilt in about a year’s time.

As well as hunting for smaller missed pockets, like B72, Apache is also looking at the downthrown sides of the reservoir, which have yet to be tested.

Meanwhile, Apache is not resting on its laurels. A drilling programme restarted in 2010 – having been halted in 2007 – is continuing and ideas from the technical group which had been “shelved”, having not met reservoir simulation models of its past masters (ExxonMobil), are now being brought back to life.

Plans are underway to bring Beryl Alpha’s two drilling derricks back into use in 2013 – only one can be used at a time at the moment.

Meanwhile, a drill crew will work on Beryl Bravo until this month, when it will move to Alpha while a turnaround is carried out on Bravo.

“We are also looking at sourcing a drilling unit for any time in the second half,” says House.

Potentially a fifth drill string could also be brought into operation which would move between Apache’s Forties field and the Beryls.

Drilling will be the name of the game for the Beryls, with four, five or even six wells a year per drill string depend on the wells, repeating the firm’s treatment of Forties.

On Forties 75 wells had been drilled when Apache took it on, he says. Apache has added another 115 to that already as seismic and drilling technology has given the company the confidence to aim at smaller accumulations with greater accuracy.

Apache is also drilling for half the cost of what the previous operator, BP, was spending, says House, and in half the time.

Apache will also be concurrently adding and improving water injection in the field.

Enhanced oil recovery technology is also being re-looked at, says House, but adds that the high costs need to be addressed by tax incentives if it is going to be viable.

In addition to its existing Beryl acreage, bought through the deal with Exxon, Apache is also waiting on bids for six-part blocks in the area, made in the 27th licensing round.

“We should be drilling on Beryl for years to come,” he adds.