Shale gas is hot property. The world appears to be awash with the stuff though quite how large the resource is possibly anybody’s guess. At best, current estimates are crude . . . no pun intended.

Yes, “unconventional” shale gas is fast becoming the pre-eminent conventional.

Cock of the walk for the time being is the US, where shale gas production has rocketed over the past six years, though it has been produced in small quantities for more than 150 years. It seems that China is poised for lift-off while, in Europe, the picture is far from clear and progress is both patchy and slow.

Concentrating on the US, shale gas now makes up more or less a quarter of domestic production, helping to offset a fall in natural gas supplies coming from conventional wells.

Shale production could double or triple over the next 25 years, according to the UK Energy Information Administration, and it could make up nearly half of US production by 2035.

That said, in January, the EIA downgraded its shale gas estimates in its Annual Energy Outlook due to a rethink of what are described a “unproved reserves”.

EIA’s new estimate for how much gas-bearing shales might yield was slashed back to 482trillion cu ft versus the 2011 estimate of 827TCF.

The most drastic change was for the Marcellus shale formation, underlying Pennsylvania, New York, and West Virginia.

The EIA used the new analysis from the US Geological Survey (USGS), along with the known histories of production from wells in the area, to draw up the 2012 fresh estimate.

The 2011 estimate for the Marcellus was 410TCF. But this included unproved reserves. The new estimate is 141TCF. However, the caveat is that the Marcellus is a new play and it will take time for companies to get to grips with its true potential.

The EIA also estimates unproved technically recoverable resources of 16TCF for the emerging Utica shale, which sits beneath the Marcellus and is relatively under-explored.

However, not everyone agrees with the EIA’s figures.

An estimate from the US Geological Survey puts the amount of unproved technically recoverable shale gas resources in the country at just 64TCF with a 90% confidence range from 43-144TCF.

Separate studies just released by two respected Canadian firms, one of Western Canadian shale gas resources and the other of the US shale gas base, have moved the tally of North American potential to a new plateau, beyond the trillions to 3.3quadrillion cu ft, according to reports by Natural Gas Intelligence (NGI).

A new analysis by ITG Investment Research entitled “No More Guessing: Hardcore IV,” shows the US Lower 48 onshore has 1.1QCF of recoverable resources across 450,000 drilling locations.

While the total includes data from 37 US shale plays, ITG estimates recoverable resources of 900TCF in just 10 overlapping plays, compared to the EIA’s estimate of 426TCF.

Oh, and next door in Canada, the potential is just as massive. Sproule Associates, the oldest and still one of the largest Canadian petroleum engineering and geology consulting firms, last week released its survey of just five of 50 shale basins that have been identified in Western Canada produced a resource base estimate of between 809 TCF and 2.2QCF.

Whatever, production of shale gas is set to rise massively. The EIA estimates that output for 2035 will be 13.6TCF; up from 5TCF in 2010. That estimate is 7% higher than the EIA’s estimate in last year’s outlook.

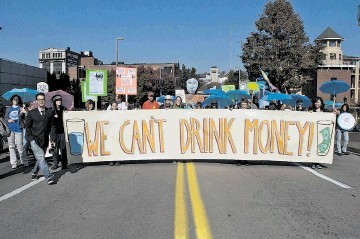

Regardless of whatever the overall shale gas resource in the US turns out to be, the industry faces an uphill challenge with regard to the vexed question of hydraulic fracking, because of widespread concern regarding the massive use of water resources and the alleged potential for pollution of groundwater . . . the natural aquifers upon which many farmers are dependent for irrigation water and communities for their water supplies.

Unfortunately, the industry’s defence is not best served by a spat that has developed between ????? and the USGS, which is claiming that the former has set about water sample analysis the wrong way.

This row is important as it could wash across to Europe where the industry is still putative and where regulation is rudimentary at best and somewhat ad-hoc.

Focal point of the dispute is a groundwater study by the US Environmental Protection Agency which focuses on the impact of hydraulic fracking near a town called Pavillion in the state of Wyoming. The EPA claims that there has been an impact, but the USGS says that the agency’s methodology is fundamentally wrong.

USGS claims that flaws identified in the EPA’s approach include improper monitoring well construction and development; possible cross-contamination of groundwater during EPA monitoring well drilling, development, and sampling; and misrepresentation of monitoring well depths in relation to drinking water well depths in the area.

Indeed. USGS has claimed that it was unable to sample one of EPA’s deep monitor wells (MW-02) because the well could not yield enough water to produce a representative groundwater sample which is due to improper well construction/development.

Geological Survey insists in two new reports that there is a need “for transparent peer-reviewed research and the use of proven and tested scientific practices”.

Recommended for you