The fallout from one of the world’s largest container ships getting stuck in Egypt’s Suez Canal is disrupting oil and LNG shipments. Crude prices are already rising as the crucial world shipping choke point is set to be cut off for at least another two days.

According to Wood Mackenzie’s Vessel Tracker, the largest impact is on container shipping, but the research company estimates that there are a total of 16 laden crude and product oil tankers which are expected to transit the canal delayed by the incident, amounting to 870Kt of crude and 670kt of clean products.

“These ships are currently in the canal itself or waiting at either the North entrance to the Suez Canal or at the Southern Suez Anchorage. There are several vessels which are located to the south of the canal entrance, which we believe are scheduled to discharge at various southern Suez ports. Our data suggests that there have been no cargoes diverted to alternative routes such as around the Cape of Good Hope,” said Wood Mackenzie principal analyst Mark Williams.

Oil retreated in Asia as traders monitored attempts to shift the giant ship blocking the Suez Canal, with market volatility jumping after two wild days that saw prices whipsaw around 6% in both directions.

Brent for May settlement slipped 1.2% to $63.65 on the ICE Futures Europe exchange at 10:24 a.m. Singapore time after rising almost 6% in the previous session.

Work to re-float the container ship that remains stuck in the canal — a key trade route for crude flows — was suspended until Thursday morning in Egypt. The best chance of freeing the vessel may not come until Sunday or Monday, reported Bloomberg.

“The impact of this disruption on the LNG market will be limited if the disruption is solved within a day or two. Only a handful of LNG cargoes were in the close vicinity of the Suez Canal when the incident started. At this stage, we don’t expect major bottlenecks, unless the situation drags on,” said Lucas Schmitt, an analyst at Wood Mackenzie.

“The Suez Canal is a key channel for LNG ships – with around 8% of global LNG trade going through. So far in March 2021 a handful of cargoes have been transiting each day in both directions (until the disruption),” added Schmitt.

“The impact could be greater if the disruption lasts longer, as the recent delays at the Panama Canal illustrated. However, the timing of this incident means it will have less impact on prices than that of the Panama since we’re entering the shoulder season for the LNG market,” said Schmitt.

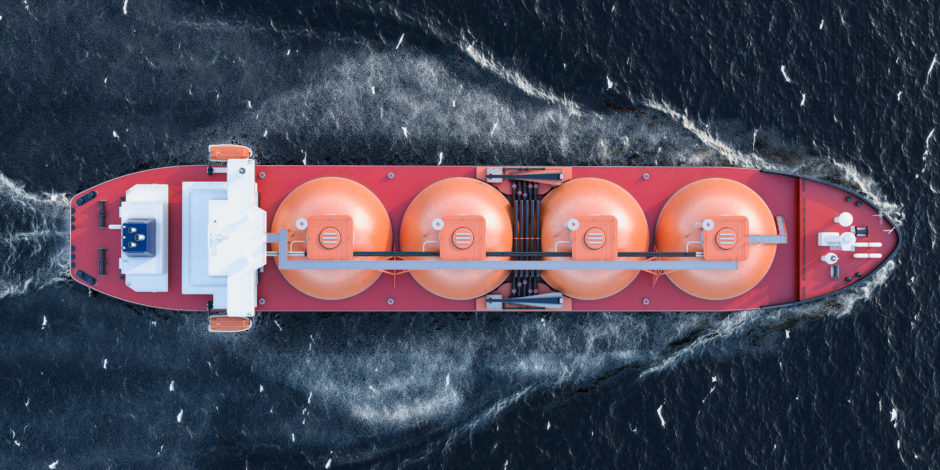

According to Wood Mackenzie’s Vessel Tracker – as of 24 March, one LNG vessel is “trapped” within the canal. The Golar Tundra loaded at Egypt’s Idku on 21 March and was transiting to Asia. At the Southern entrance, the Rasheeda is awaiting to transit with a shipment from Qatar.

As of 5:50 PM CET, there are three LNG tankers (two full, one empty) waiting or approaching the south side of the Canal, two full tankers waiting at the north entrance, and the full Golar Tundra is stuck in the middle. Meanwhile, at least one US export, the Pan Americas, has potentially been rerouted in the North Atlantic towards the Cape of Good Hope, away from its previous heading towards the Mediterranean/Suez.

The Ever Given, the 400-meter container ship operated by Taiwan-based Evergreen Group, became stuck sideways Tuesday in one of the world’s busiest shipping lanes, choking off the shortest shipping route from Asia to Europe. Egypt’s Suez Canal Authority blamed the incident on low visibility from a sandstorm.

Eight tugboats were still at work yesterday trying to dislodge the vessel. The effort to reopen the canal will take at least two days, The Associated Press reported, but the time it will take for full recovery remains an open question.