UK-Dutch oil company Royal Dutch Shell is finding it hard to replace oil and gas reserves as it continues with plans to increase production and pay a higher dividend.

Announcing full-year results yesterday, Shell said profits in the final quarter of 2012 missed expectations, despite rising 15% on 2011 levels to £3.5billion on an adjusted current cost of supplies (CCS) basis.

Shell’s refining operations returned to profit in the quarter but analysts were more concerned about a 14% fall in earnings from its upstream division, to £2.75billion.

Full-year CCS profits ended down at £17billion for 2012, from £18billion the previous year.

David Barclay, a divisional director at wealth manager and financial-planning specialist Brewin Dolphin in Aberdeen, said: “Investors expressed their disappointment with Royal Dutch Shell’s fourth-quarter results, with the shares closing off 68p at £22.94.

“The contribution from the upstream division in particular was nearly one-fifth below what had been a wide range of estimates.

“Higher-than-expected expenses for exploration, higher startup costs and disruptions to oil tarsand production in Canada were the main reasons.

“There were some positives contained in the statement, particularly for income investors. With cash flow strong and only a modest increase in the capital expenditure budget, the board plans to increase the quarterly dividend by 7% in US dollar terms in the first quarter of 2013.”

Shell replaced just 44% of its used reserves last year, however. Andrew Whittock, of investment bank Liberum Capital, said the figures offered little comfort that exploration and production volume growth was sustainable.

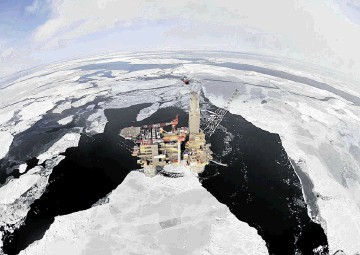

Exploration investment, focused on deep water, is planned to increase by 10% in 2013, to £4.4billion, with the drilling of 40 wells planned for this year and next. Shell expects to raise its output to about 4million barrels of oil and gas equivalent per day by 2017-18, from 3.3million now.

Chief executive Peter Voser said: “Shell’s efforts to expand its pipeline of potential energy projects are paying off. Our drive to increase our options for future projects means that we are more constrained by limits on capital than by limits on opportunities.”

Recommended for you