As Europe’s oil majors prepare to host their annual shareholder meetings, one topic is garnering almost all the attention.

Climate change looms large for Royal Dutch Shell Plc, BP Plc and Total SE, with investors at all three energy giants calling for greater action. Shareholder resolutions on cutting carbon emissions are set to dominate this month’s AGMs, even as the companies talk up their own, competing proposals.

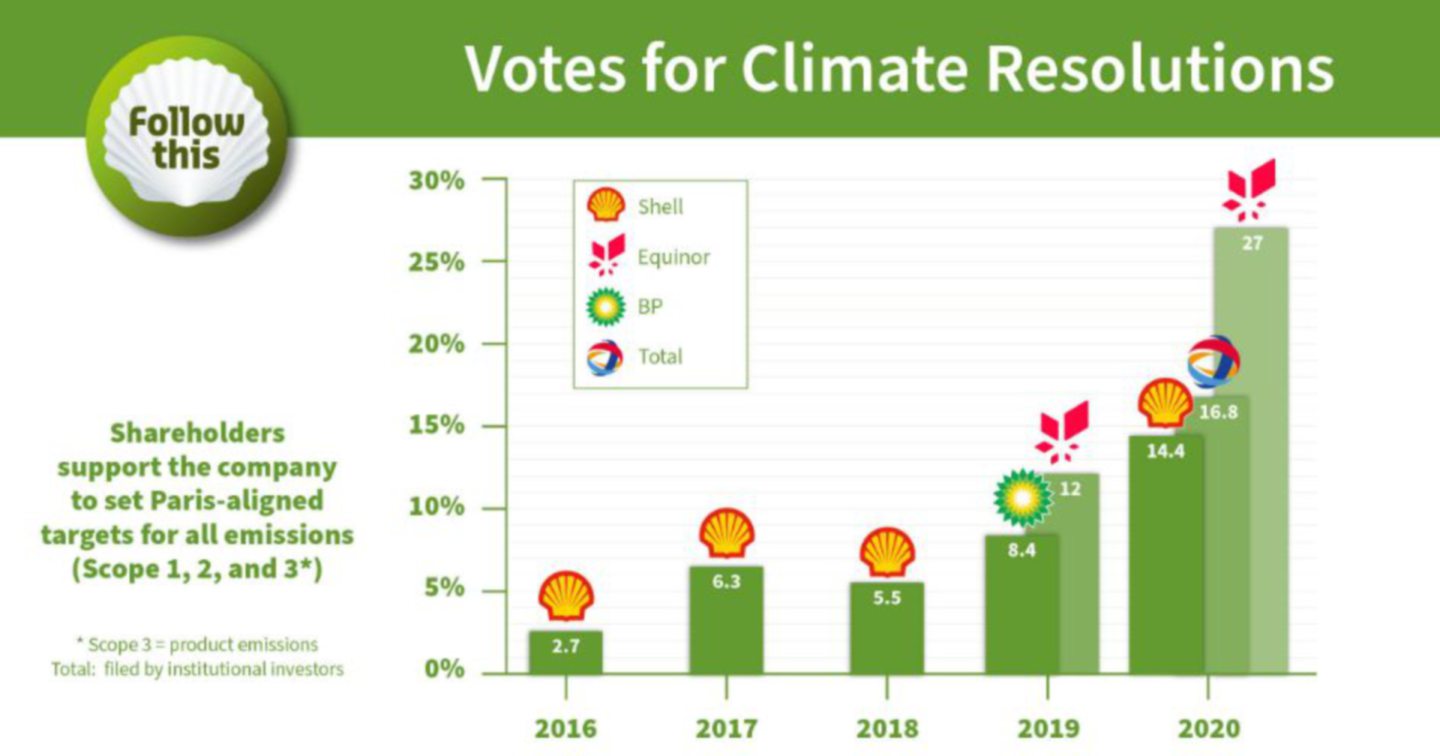

Key activist group Follow This, which has been a thorn in their side in recent years, is putting forward a motion at BP on May 12 and Shell six days later, urging the companies to set emission goals aligned with the Paris Agreement.

Shell’s board has snubbed the idea, insisting its own plan to pump less oil, produce more gas and renewables, and slash emissions over the next 30 years is “more comprehensive.” BP is also asking investors to reject the resolution.

Since the votes are non-binding, they’ll have only a limited impact on strategy, yet they ratchet up pressure on companies still reliant on fossil fuels to fund the shift to cleaner energy. Shell agreed in February to put its transition plans to a vote, while Total pledged the same in March.

“This has all come along faster than everyone expected,” and the imminent votes give “very little time to review the commitments,” said Shu Ling Liauw, lead global analyst at the Australasian Centre for Corporate Responsibility. “It’s a bit of game theory and opportunism to cement themselves as having endorsed climate plans,” but “that doesn’t mean there’s substance.”

Support among investors remains mixed. In the Netherlands, resolutions tabled by Follow This — which was founded by Dutch campaigner Mark van Baal — have been backed by several large players such as NN Investments and Aegon NV. Yet advocates among the biggest U.S. investors are harder to come by. BlackRock Inc., for example, has always voted against the group’s proposals.

Norway’s sovereign wealth fund, which has a 1.4 billion-pound ($2 billion) stake in BP, said Friday that it, too, would side with the U.K. company.

At Shell, smaller shareholders such as London-based Sarasin & Partners LLP and U.K. local authority pension funds have said they’ll favor Follow This over the company’s transition plan. But the main proxy advisory firms — Glass, Lewis & Co. and Institutional Shareholder Services — are standing by the oil majors and urging clients to reject the resolutions at both Shell and BP AGMs.

Net Zero

In recent years, large oil companies have outlined plans to cut carbon output, with Europe’s top three all declaring “net-zero” targets for 2050. Yet according to Climate Action 100+, an investor group with $54 trillion under management, none of the majors have fully disclosed how they’ll erase their net emissions.

“Companies need to show us what they can do,” said Adam Matthews, chief responsible investment officer at the Church of England Pensions Board, which engages with Shell on climate matters on behalf of CA100+. “There are legitimate questions about the path” to net-zero at the Anglo-Dutch firm, though “the goal is clear and unambiguous, and Shell is accountable for delivering that target,” Matthews wrote in an article last month.

The promise of change is also no longer enough for London-based Epworth Investment Management Ltd., which manages investments for the Methodist Church and has recently exited all oil and gas. Chief Executive Officer David Palmer has called Shell’s emission targets “uninspiring,” concluding that “we cannot say that Shell is aligned with the objectives of the Paris Accord.”

While Epworth may be a minnow next to BlackRock, which holds a stake of more than 3 billion pounds in Shell, it touches on the use of divestment as a tool to pressure companies. It also calls into question divestments made by the majors themselves — asset sales that shift some emissions off their books by simply transferring them to another operator.

“We’ve actually got to follow these emissions and make sure that we’re sorting out a transformation, not just a ‘prettification’ of our portfolios,” said Anne Simpson, director of board governance and strategy at the California Public Employees’ Retirement System and chair of CA100+. “We’ve got to move this dialogue from the advisory, shareholder-proposal world and into board accountability,” she said in a webinar.

CalPERS has voted in favor of Follow This resolutions in the past. But this time around it has flagged that it won’t support the group’s resolution at BP, citing “concerns with the duplicative nature of the proposal and its binding intent.” That’s despite comments by Simpson that around 60% of BP’s spending plan is not aligned with its climate commitments.

Recommended for you