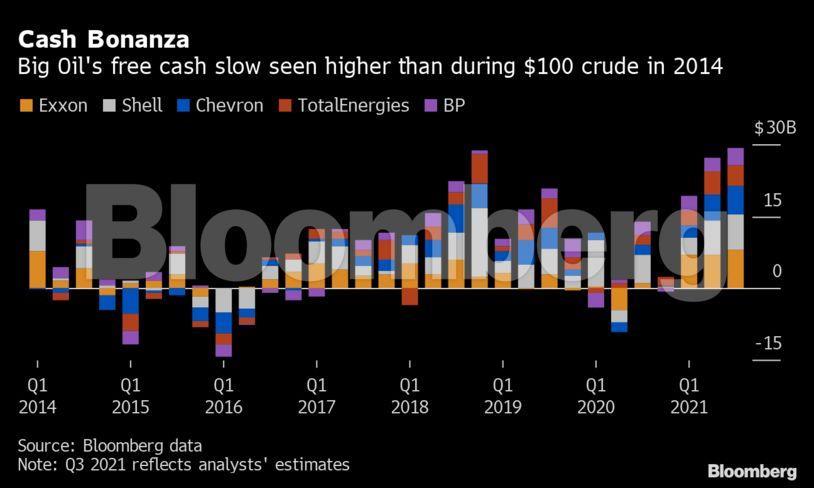

The Western world’s biggest oil companies likely just generated more cash than at any time since the Great Recession, and investors are about to find out what they’ll do with it.

The five supermajors – starting with Royal Dutch Shell and TotalEnergies, who release earnings on Thursday 28 October – will report about $29 billion in free cash flow combined in the third quarter, according to analysts’ estimates compiled by Bloomberg. That would be the most since the beginning of 2008. Strong demand for crude, surging prices for natural gas and chemicals, and a rebound in the refining business are likely to be the main drivers.

An upbeat set of results would help cement a remarkable turnaround after a painful 2020, in which Big Oil was forced to cut costs and employees, shelve spending plans and take on debt. Shell and BP even resorted to cutting their vaunted dividends. Shareholders are now anxious to see whether the companies will return their windfalls via higher dividends or stock buybacks – or use them to produce more oil and gas.

“We’re seeing really strong results on the free cash flow side,” said Noah Barrett, a Denver-based analyst at Janus Henderson Investors, which has $428 billion under management. “But on the earnings calls we need to hammer on whether it’s sustainable, or whether the majors are starving the core business of capital.”

Exxon Mobil and Chevron report on Friday, with BP bookending the results on 2 November.

Executives at publicly traded oil companies have so far this year been keen to reinforce their commitment to spending discipline, even in the face of soaring commodity prices that would have prompted a raft of fresh spending on new megaprojects in previous boom cycles. Instead they’re focused on paying down debt and returning cash to shareholders following a decade of weak financial performance even before the pandemic, plus emerging risks posed by the energy transition.

As such, Exxon investors will be focused on the “path forward for incremental shareholder returns” this quarter, Goldman Sachs analysts wrote in a note. Chevron also has the potential to increase its share buyback, according to Morgan Stanley. BP could announce $600 million worth of incremental buybacks in the third quarter, while Shell might hold off on further repayments until the final quarter of the year, Jefferies analyst Giacomo Romeo wrote in a research note. France’s TotalEnergies has already promised to buy back $1.5 billion of shares in the fourth quarter.

Still, buybacks and dividends aren’t the only option for all that cash. With Europe and Asia short of gas, and the U.S. and India calling for OPEC+ to produce more oil, the profit incentive to drill for more fossil fuels is increasing as the majors plan their 2022 capital budgets. Executives should be cautious in overcommitting to shareholder returns because the good times might not last, according to HSBC.

“As strong as the near-term financial outlook is for the sector, we aren’t convinced the oil and gas prices driving the latest rally are sustainable,” London-based analyst Gordon Gray said in a note, citing continued valuation headwinds over energy transition risks.

What to watch for:

Gas boom

- Average European gas prices almost doubled quarter on quarter, while in the U.S., Henry Hub jumped 45%

- Exxon signaled a gain of about $700 million from natural gas in a Sept. 30 trading update

- Gains from liquefied natural gas sales often trail the market by a few months, meaning sky-high spot prices may only feed through in 4Q

Refining rebound

- Gulf Coast crack spreads increased 11% quarter on quarter, while in Europe they rose 16%, according to Morgan Stanley

- Exxon’s downstream division should end four consecutive quarters of losses

- Jet fuel demand is improving, boosting Chevron’s large West Coast refineries

Chemicals strength

- Higher natural gas liquid-input costs may erode chemical margins from the second quarter, but demand remains high for petrochemicals that go into plastics, benefiting Exxon and Shell in particular

- Gulf Coast prices for PVC, used in water pipes and window frames, touched a record high in the second quarter

Trading

- Shell and BP have vast trading operations that can add billions to their bottom lines every year

- Shell appears to have been on the right side of big swings in gas and power prices, with the company flagging that its gas trading desk performed better than in the second quarter

- BP hasn’t disclosed any updates on its trading unit, but its gas and power desks did get off to a good start this year due to a winter freeze in Texas that sent prices soaring

Oil

- Brent crude averaged $73.26 a barrel in the third quarter, compared with $69 a barrel in the second quarter

- Production from the Gulf of Mexico took a major hit when Hurricane Ida damaged key oil infrastructure, forcing some facilities to shut down for weeks

Oilfield servicers

- Baker Hughes Co. and Halliburton Co. suffered earnings knocks due to the hurricane

Recommended for you

© Supplied by Bloomberg

© Supplied by Bloomberg