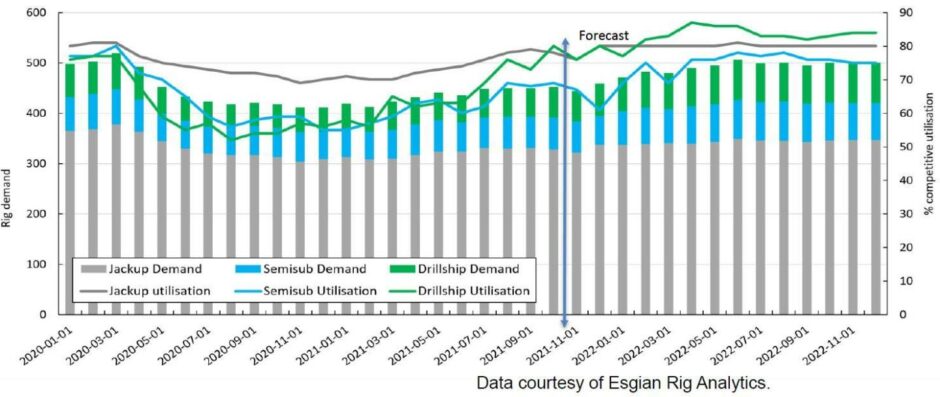

Scrapping and cold-stacking have reduced the global offshore rig supply, while stable commodity prices drive increased activity and greater utilisation heading into 2022, according to rig analysts Esgian.

Data from Esgian – formerly Bassoe Offshore – shows an ongoing reduction in global rig supplies, with 83 more rigs retired than delivered over the past four years and supplies believed to be at the lowest levels since 2005.

However, the re-sizing of the market is spurring a pick-up in utilisation rates, which have risen by 12 percentage points since their low of 66% in July 2020, as higher oil prices drive renewed demand.

Indeed, rig tendering activity is believed to be back at pre Covid levels in some segments, the firm said in a mid-December update.

This market outlook is reflected in the orderbook for new units. While a sizable amount remain in global shipyards – 36 jack-ups, 6 semi-submersibles and 18 drillships recorded as of mid-December – almost no new orders are being placed.

Meanwhile, the story of consolidation amongst the larger players continues. Since 2014, Esgian said seven major M&A transactions have seen 12 drilling companies become five – not counting the recently announced merger of Maersk and Noble.

Yet while these mergers have seen a concentration of the highest-spec rigs, the overall market remains diverse. “The top ten drillers really only control about 40% of the fleet, so really it’s still very fragmented,” said senior rig market analyst Teresa Wilkie.

“Even with the Noble and Maersk transaction, this will only bring that figure up to about 43%.”

Several rig owners have also either emerged from, or are soon to exit, Chapter 11 bankruptcy proceedings, though this time they do so with stronger balance sheets and in a market with stronger oil prices.

“All of this is really paving the way for more consolidation,” explained Ms Wilkie.

Rig backlog

The impact of higher prices is seen in the order backlog. In the year up to late November 2021, 269 years of backlog were added, compared with 156 years awarded over the same period in 2020, Ms Wilkie added, though it has not been seen equally across all markets.

Modern drill ships have seen the greatest rebound in demand particularly in the Gulf of Mexico and Brazil, while the global outlook for jack-ups more stable and semi-submersibles is slightly weaker.

The exception is for harsh-environment semi-subs in the UK and Norway, where Esgian said day rates could rise during in 2022 and 2023, owing to smaller supplies and the potential for more drilling activity.

UK and Norway

Looking to the North Sea, Esgian expects a tighter market in 2022 and 2023, owing to higher decommissioning and development activity in the UK and potentially in Norway.

The UK continues to have a “very limited” supply of semi-subs in particular. Owing to continually low demand, that has not been an issue. However, Ms Wilkie cautioned that due to that limited supply, “it really wouldn’t take much for that market to sell out,” if activity was to suddenly increase.

Indeed, with known projects alone, utilisation of semi-subs could reach 85%, she said.

Dayrates “not expected to skyrocket”, Esgian said, but could edge closer to the $200,000 per day mark during the course of the year.

The outlook for jack-ups is steady, with strong tendering activity over the past few months but supply is still likely to outpace demand, and current requirements are understood to be highly competitive.

Esgian’s forecast for the Norwegian market expects demand to remain fairly flat. However, recent tax incentives put in place in 2020 may result in more projects moving towards final investment decision (FID), driving more investment and development drilling from 2023 onward.

Accordingly, day rates are anticipated to stagnate in 2022, though “sizeable increases” are expected from 2023-25.

Looking ahead, Ms Wilkie also pointed to the spike in interest around emissions reduction technology for drilling units, as operators increasingly look at their operational carbon footprint – particularly in markets such as the North Sea

“The number of rigs being upgraded with fuel and emission reducing systems has really taken off in the past year, and that’s a trend we expect will only continue in the future,” Ms Wilkie said.

In addition, she said rig owners would look to new opportunities for energy transition projects, such as carbon capture and storage projects, which may prompt further upgrades.

© Supplied by Esgian

© Supplied by Esgian