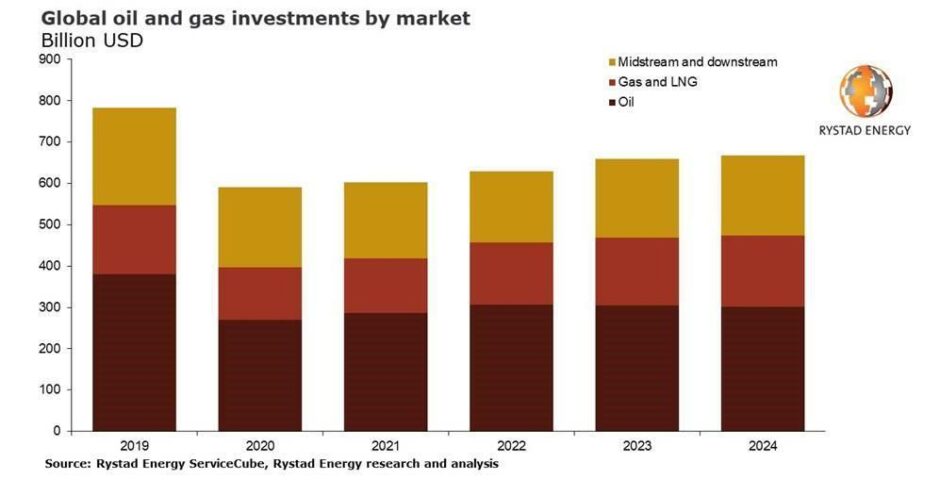

Global oil and gas investments will expand by $26 billion this year on the back of upstream gas and LNG expenditure, according to analysis by Rystad Energy.

Oslo-headquartered Rystad Energy forecasts that total oil and gas investment will rise 4% to $628 billion this year, from $602 billion in 2021, as the industry continues its “protracted recovery.”

Rystad notes a 14% increase in upstream gas and LNG investments as key drivers of the uptick, and the fastest-growing sectors over the year. Investments here are expected to rise from $131bn in 2021 to around $149bn in 2022.

Although still below pre-pandemic levels, analysts expect commitments to surpass 2019 levels of $168 billion in just two years, reaching $171 billion in 2024.

Meanwhile, upstream oil investments are projected to rise from $287 billion in 2021 to $307 billion this year, a 7% increase, while midstream and downstream investments will fall by 6.7% to $172 billion.

“The pervasive spread of the Omicron variant will inevitably lead to restrictions on movement in the first quarter of 2022, capping energy demand and recovery in the major crude-consuming sectors of road transport and aviation. But despite the ongoing disruptions caused by Covid-19, the outlook for the global oil and gas market is promising,” says the firm’s head of energy service research Audun Martinsen.

Shale “surge”

Continuing the breakdown by sector, global shale investments are expected to “surge” by 18% over the year, reaching $102bn – compared with $86 billion in 2021.

Offshore investments are set to increase 7% to $155bn, while conventional onshore rises by 8% to $290bn.

Rystad notes Australia as a particular highlight, where greenfield projects will push investment up by one-third, and the Middle East where 22% investment growth is expected as Saudi Arabia boosts oil export capacity and Qatar expands production and export capacity of liquefied natural gas (LNG).

Greenfield investments nearly doubled in 2021, with $150 billion worth of projects sanctioned compared with $80bn the prior year, and Rystad expects similar levels in 2022.

In North America, more than $40bn in projects are slated for sanctioning over the course of the year, including six LNG projects – five in the US and one in Canada.

Rystad noted TotalEnergies’ North Platte project in particular, alongside LLOG Exploration’s Leon and Chevron’s Ballymore developments in the US Gulf of Mexico, as each approaches development in 2022.

However, Africa is likely to see a quieter year, with projects worth a “comparatively small” $5bn, analysts added.

2022 offshore outlook

Around 80 offshore projects, worth a total of $85bn, are up for approval in the coming year.

Ten of these are floating production storage and offloading units (FPSOs), 45 involve subsea tiebacks, and 35 are grounded platforms.

Latin America and Europe are each responsible for around 24% of the total offshore sanctioning values next year, with deepwater expansions expected in Guyana, Brazil and Norway following recent tax changes, analysts said.

Notably however, while the volume of offshore projects is expected to rise, capital commitments are likely to remain around the same, they said.

Rystad noted the “outstanding concern” of execution challenges related to the pandemic, as well as increased inflationary costs for steel and other input factors, likely to lead to operators being “mildly cautious” in terms of capital commitment.

Alongside this, many major energy companies are adapting their portfolios to meet the energy transition, and accordingly many E&P companies have already begun directing investment towards low-carbon energy sources.

This is good news for some contractors and the supply chain, as spending on offshore wind reached nearly $50bn in 2021 – double that seen in 2019 – and Rystad expects this to reach $70bn by 2025.

Meanwhile, the offshore oil and gas sector is set to face “a challenging energy transition period”, as low-carbon investments take precedence. Accordingly, Rystad said oil demand is “likely to peak in the next five years,” ultimately capping offshore investment at around $180bn by 2025.

Recommended for you

© Supplied by Rystad Energy

© Supplied by Rystad Energy