New analysis from the International Energy Agency (IEA) suggests adopting a suite of measures could enable the European Union to reduce its imports of Russian gas by more than one-third within a year.

It comes as the energy sector rushes to respond to Russia’s invasion of Ukraine, spurring a raft of high-profile divestments and exits from businesses and supply agreements.

On Thursday the IEA proposed a combination of actions spanning gas supplies, the electricity system and end-use sectors, which could support the bloc’s energy security and affordability, and which it says are consistent with the European Green Deal.

The report – A 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas – follows calls from business, including from the likes of Orsted boss Mads Nipper, for a coordinated approach to minimise the impact of Russian sanctions on society.

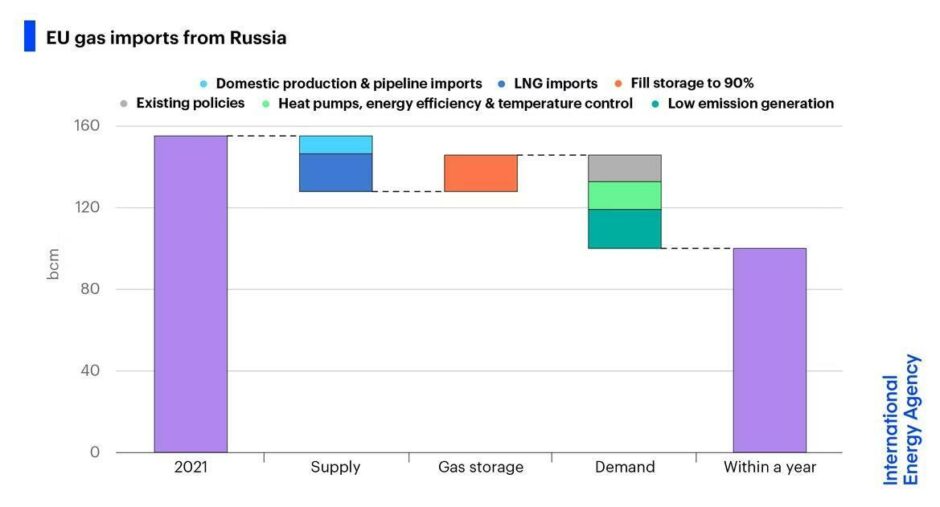

In 2021, the European Union imported an average of over 380 million cubic metres per day of gas by pipeline from Russia, or around 140 billion cubic metres (bcm) per year.

In addition, around 15 bcm was delivered in the form of liquefied natural gas (LNG).

The total 155 bcm imported from Russia accounted for around 45% of the EU’s gas imports in 2021 and almost 40% of its total gas consumption.

Adopting its proposed ten steps could reduce the EU’s imports of Russian gas by more than 50 bcm, or over one-third, within a year, the IEA estimates.

This also takes into account the need for additional refilling of European gas storage facilities in 2022.

Only around 5% of the UK’s gas supplies come from Russia, while nearly half are sourced from the UK North Sea.

The IEA’s ten recommendations are as follows:

- Do not sign any new gas supply contracts with Russia.

[Impact: Enables greater diversification of supply this year and beyond] - Replace Russian supplies with gas from alternative sources

[Impact: Increases non-Russian gas supply by around 30 billion cubic metres within a year] - Introduce minimum gas storage obligations

[Impact: Enhances resilience of the gas system by next winter] - Accelerate the deployment of new wind and solar projects

[Impact: Reduces gas use by 6 billion cubic metres within a year] - Maximise power generation from bioenergy and nuclear

[Impact: Reduces gas use by 13 billion cubic metres within a year] - Enact short-term tax measures on windfall profits to shelter vulnerable electricity consumers from high prices

[Impact: Cuts energy bills even when gas prices remain high] - Speed up the replacement of gas boilers with heat pumps

[Impact: Reduces gas use by an additional 2 billion cubic metres within a year] - Accelerate energy efficiency improvements in buildings and industry

[Impact: Reduces gas use by close to 2 billion cubic metres within a year] - Encourage a temporary thermostat reduction of 1 °C by consumers

[Impact: Reduces gas use by some 10 billion cubic metres within a year] - Step up efforts to diversify and decarbonise sources of power system flexibility

[Impact: Loosens the strong links between gas supply and Europe’s electricity security]

“Nobody is under any illusions anymore. Russia’s use of its natural gas resources as an economic and political weapon show Europe needs to act quickly to be ready to face considerable uncertainty over Russian gas supplies next winter,” said IEA Executive Director Fatih Birol.

“The IEA’s 10-Point Plan provides practical steps to cut Europe’s reliance on Russian gas imports by over a third within a year while supporting the shift to clean energy in a secure and affordable way. Europe needs to rapidly reduce the dominant role of Russia in its energy markets and ramp up the alternatives as quickly as possible.”

However, its analysis highlights some trade-offs. While accelerating investment in clean and efficient technologies forms a major component of the solution, it said even very rapid deployment of these technologies would take time to make a major dent in demand for imported gas.

“The faster EU policy makers seek to move away from Russian gas supplies, the greater the potential implications in terms of economic costs and/or near-term emissions. Circumstances also vary widely across the EU, depending on geography and supply arrangements,” the agency said.

Analysts also considered additional scenarios in which Europe could go further and faster to limit near-term reliance, though it said these steps would mean a slower near-term pace of bloc-wide emissions reductions.

If Europe were to take these additional steps, then near-term Russian gas imports could be reduced by more than 80 bcm.

Recommended for you

© Supplied by IEA

© Supplied by IEA