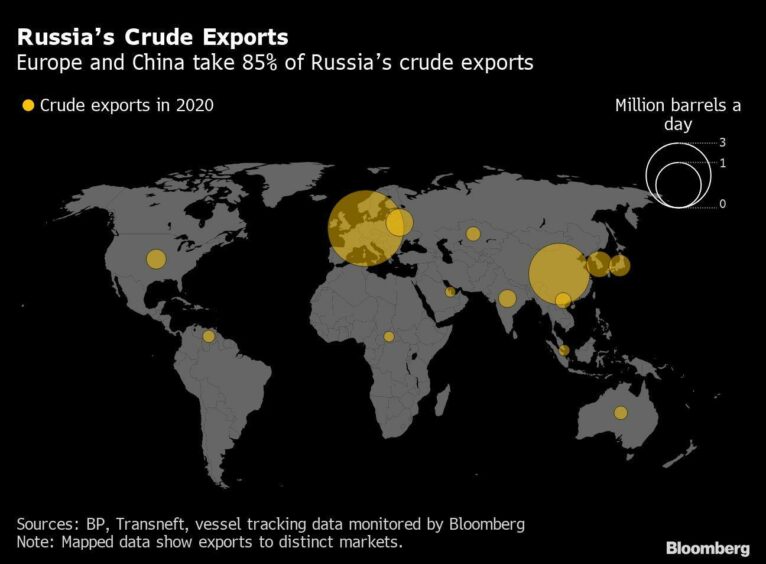

Two weeks into Russia’s invasion of Ukraine, and one question is becoming increasingly pivotal in the global oil market: how much crude will Asia buy from Moscow?

With many of Europe’s largest oil companies including Shell Plc, TotalEnergies SE, BP Plc, Eni SpA lining up to say they’ve essentially halted new cargo purchases, and the US and UK announcing petroleum import bans, attention is turning to where else the crude might flow.

And that means the scale of demand from Asia, the world’s top oil-importing region — in particular China — could prove essential. There are tentative signs that a largely self-imposed buyers’ strike is holding there too.

Asia matters because if all the world’s major demand centers stop buying, then Russian oil supply and Moscow’s revenues from it, would be severely pressured. Likewise, the global market could risk a drop in the availability of crude.

But under an opposite scenario where one region buys what others won’t, the end result would more likely be a rerouting of global petroleum flows. Asia takes more Russian barrels and Europe compensates with cargoes from the Middle East, for example. That would do far less damage to Russian sales, or to global oil supply.

Demand Void

Traders both in Asia and in Europe said it’s far from clear to what extent Asian buyers are filling the demand void left by their counterparts elsewhere, with deals being transacted privately and some buyers wary. There are currently no sanctions that would directly prevent such trades.

The financing of purchases has become challenging because of sanctions against Russia following the invasion, and other buyers were alarmed at criticism Shell received for buying a cargo of the nation’s crude late last week, according to traders.

Right now, several Asian refiners — including Chinese companies that are among top buyers of Russian oil — are not considering fresh Russian purchases, according to traders who deal with the nation’s grades.

That wariness extends from buying of Urals for loading in the next few weeks from ports in western Russia, to grades due to be loaded in the Far East as far into the future as May.

New Bookings

No new supertankers have been booked recently to move Urals to Asia and demand for vessels — at least from companies that are openly looking for tankers, is slow, according to shipbrokers.

Unipec, the trading arm of Sinopec Group, booked the vessel Agios Fanourios I late last month for ship-to-ship transfers of Urals in late March to China but the booking didn’t get completed, they said.

In the past, Unipec was one of the top five buyers of Urals. It lifted a total of about 22 million barrels of Urals last year, according to shipping tracking data compiled by Bloomberg. It has moved four supertankers of Urals from Baltic ports to China so far this year, all before the invasion.

Teapots Curbed

Sky-high oil prices and an uncertain sanctions environment are also making it harder for a group of small private Chinese refiners, known as teapots, to finance purchases. Freight costs are also very high for Russia-related business, further prohibiting seaborne trade.

Rather than buying Russian barrels, the teapots are mulling a reduction in how much crude they process, people familiar with the matter said.

Even in India, which has so far avoided condemning Russia’s invasion of Ukraine, buyers haven’t been active in Russian crude in recent weeks, traders said. There’s been a reduction in activity since the nation’s refiners snapped up millions of barrels of Urals crude late last month, the traders said.

That wariness is in evidence in offer prices for crude from eastern Russia.

Earlier this week, a May-loading cargo of Russian Far East Sokol crude was offered at a discount of as much as $14 a barrel to the benchmark Dubai price. In early March the same grade was on offer at a premium of $1 a barrel.

Recommended for you