The CEO pay packets of Europe’s oil supermajors continue to trail that of their American counterparts, as Energy Voice explores earnings amongst the sector’s top execs.

Having weathered a global pandemic, resulting in widespread losses and forgone bonuses across the sector in 2020, oil and gas executives saw their fortunes reversed last year with record results across the board.

Exceptional results amongst supermajors have seen sizable remuneration packages awarded to top executives – but despite their comparable performance, European CEOs trail their counterparts in US-headquartered firms.

We’ve benchmarked all values in US dollars here for easier comparison.

Shell CEO Ben van Beurden took home a £6.1 million pay package (issued in euros) following an “impressive financial performance” for the oil giant, including a bonus of £2.1m and share awards, in addition to his £1.34m salary.

His pay and benefits are around 57 times that of an average employee, which stood at £119,112 in 2021 according to Shell’s annual report.

Meanwhile BP chief executive Bernard Looney secured more than £4.4m last year, with bonuses of £2.4m alongside his £1.3m salary. Together with performance-related share awards and cash in lieu of retirement benefits, Mr Looney’s compensation stood at around 87 times that of the median BP employee.

His salary will increase in 2022 by 4.25% this year to just under £1.4m.

Also read: Cultural issues holding back female talent in the UK, report finds

Linda Cook, the CEO of Harbour Energy – the UK’s largest independent oil and gas producer – will take home a package worth £5.9m for 2021, having joined the company last April.

In addition to her £637,000 salary for her nine-month tenure, she receives a performance related bonus of £422,000 and another buyout award of £4.5m in shares, which the company granted “to compensate for the loss of incentive arrangements she had as part of her employment at EIG.”

Moreover, 2021 saw Harbour increase its annual bonus policy from 120% of salary to 200% of salary and increase in potential long term incentive plan awards from 200% of salary to 300% of salary.

Ms Cook’s full-year salary for 2022 will total £850,000.

TotalEnergies chairman and CEO Patrick Pouyanné was awarded around £3.3m, including a €1.4m (£1.17m) salary for 2021, as well as a performance-related bonus of over €2.5m (£2.1m) and other in-kind benefits – up around 20% up on the previous year’s total of just over €3.2m.

Mr Pouyanné was also granted 90,000 shares, worth €1,972,800, again in relation to company performance targets.

In total, his compensation is around 59 times that of the median TotalEnergies employee, according to company filings.

Bigger in America

Across the pond however, the head of ConocoPhillips, which posted $12.7 billion in pre-tax profits for 2021, received a far larger compensation package than his European counterparts.

Chairman and CEO Ryan Lance’s 2021 salary stood at $1,615,000 for 2021.

The company’s board also awarded him an additional payout at 170% of target, reflecting “the most extraordinary year on record for the company”, securing a further $5 million in performance-based compensation, in addition to $14.4 million in stock awards for the year.

Coupled with pension awards and other compensation, Mr Lance’s total remuneration stood at more than $23.9m for the year – less, in fact, than the $30m and $28m he took home in 2019 and 2020, respectively.

The ratio of pay of the CEO compared to that of the median ConocoPhillips employee was approximately 133 to one in 2021.

Meanwhile, Exxon Mobil CEO Darren Woods is set for a $23.6m payday for 2021 performance, consisting of a similarly benchmarked $1,615,000 salary, $3.1m bonus package and $13.5m in stock awards, as well as pension contributions and other benefits, according to proxy filings that will be put to a shareholder vote next month.

Exxon’s full-year 2021 profits totalled $23bn, compared with a loss of $22.4bn in 2020.

Notably, Mr Woods compensation package included nearly $75,000 for private security. He too will receive a payrise in 2022, to just over $1.7m.

The ratio of total CEO compensation to the median total compensation for Exxon employees was 125:1.

Finally, Chevron chairman and CEO Mike Wirth will secure a $22.6m package for 2021, consisting of a $1,650,000 salary, $4.5m in bonuses, $12.2m in stock awards and a further $3.8m in option awards, as well as other benefits.

This too will be put to a shareholder vote later this year, along with a $50,000 increase to Mr Wirth’s base salary for 2022.

While far and above his European counterparts, his 2021 remuneration is nearly a third lower than in 2020, in which he was awarded over $29m, mainly as a result of gains in pension value and other deferred compensation.

Mr Wirth’s total compensation was 123 times that of the median Chevron employee.

‘Obscene’

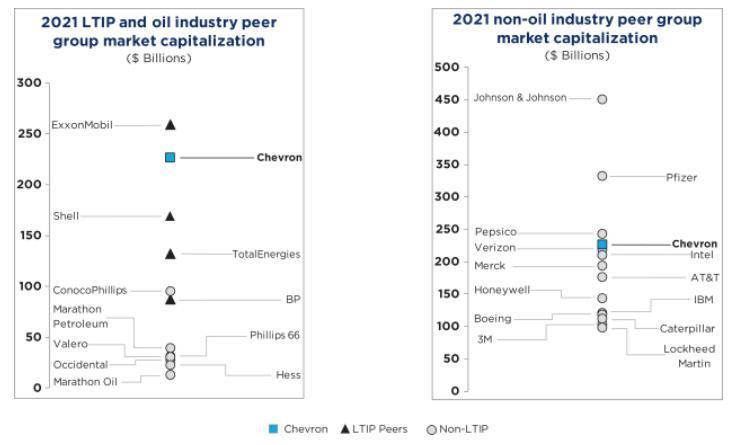

Oil companies have historically emphasised the need to align remuneration and talent with that offered by competitors from within and without the energy sector.

In its proxy filing, Chevron noted the need to compete “for stockholder investment and employee talent”, benchmarking its size and performance against comparable companies in this table.

However, RMT regional organiser Jake Molloy called the awards “obscene.”

“As every family in this country and many more struggle to cope with rising energy bills forcing them into desperate decisions around heat or eat, these figures should serve to demonstrate we need change to bring about a fairer and just society,” Mr Molloy added.

© Supplied by Energy Voice

© Supplied by Energy Voice © Supplied by Chevron 2022 Proxy S

© Supplied by Chevron 2022 Proxy S