Public exploration and production (E&P) companies are set to achieve new record-high profits in 2022, amid bumper cash flows and low levels of reinvestment.

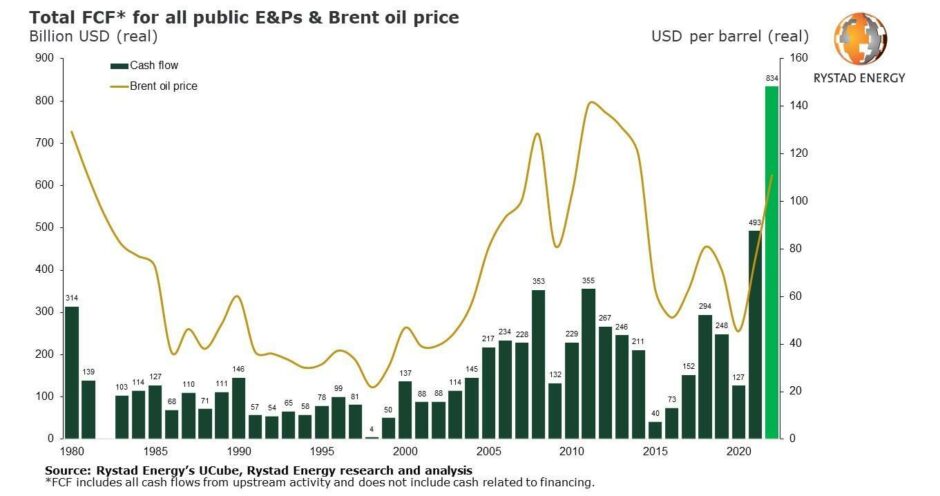

Research by analysts Rystad Energy shows that total free cash flow (FCF) amongst E&Ps will balloon to $834 billion in a “blockbuster” 2022 – a 70% increase on the $493bn reported last year.

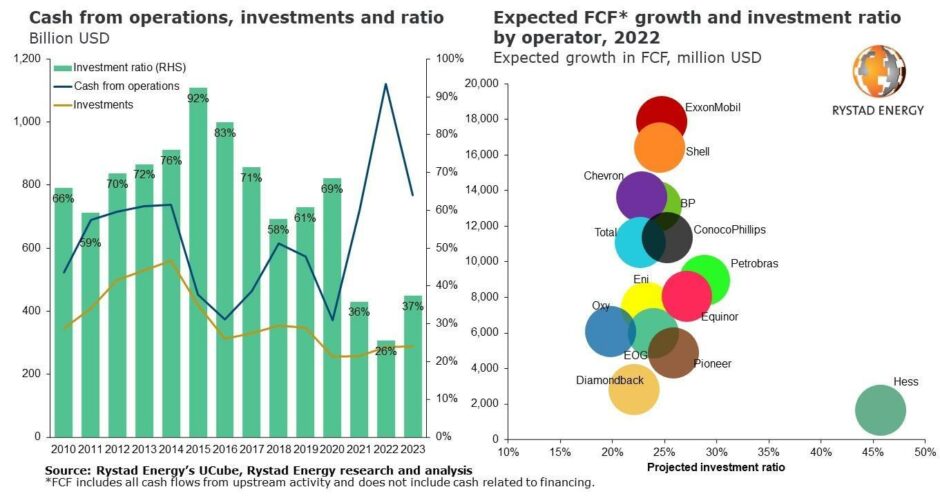

Meanwhile, it expects cash from E&P operations will break $1 trillion for the first time ever.

FCF includes cash from a company’s operations after outflows and asset maintenance. Total FCF from public E&Ps – including the likes of ExxonMobil, BP and Shell – fell to around $126 billion in 2020 as a result of the Covid-19 pandemic and the ensuing oil price collapse – half that of 2019.

However, as the global economy rebounded and fuel demand increased last year, FCF levels surged to nearly $500bn, the highest profits ever for the upstream industry, and are now set to boom even further this year.

Espen Erlingsen, Rystad Energy’s head of upstream research noted: “The current financial health of public upstream operators is at an all-time high. Still, the good times are set to get even better this year, thanks to a perfect storm of factors pushing profits and cash flow to another record high in 2022.”

Rystad said sustained high oil and gas prices were the primary driver of record profits. Brent crude prices are set to average at $111 per barrel in 2022, with Henry Hub gas prices at $4.2 per thousand cubic feet and European gas prices at $25 per thousand cubic feet.

Meanwhile, cash from operations is anticipated to reach $1.1 trillion – a 56% jump from 2021 levels of $719bn, which was the highest yearly total since 2014.

It is this capital which is typically used to fund new investments and financial costs, such as debt payments and dividends. In 2020, cash from operations dropped by almost $200bn, around 35%, Rystad said, implying companies had less money to finance new activity and pay dividends.

Accordingly, investment also dropped that year, falling by around 30%, or almost $100bn.

However, despite the boom in cash flow, investments are not expected to grow significantly this year, and will instead see a marginal rise from $258bn last year to $286bn in 2022.

This “shows the disparity between record cash flow and profits, and the portion of those windfalls that are reinvested,” Rystad said.

The ratio has fluctuated over the past decade, averaging around 72%, but this year is likely to fall to just 26% – the lowest since the early 1980s.

“The meager investment ratio and soaring FCF indicate that public E&P companies will have significant cash available to pay down debt or fork out dividends to shareholders,” analysts said.

“Much of last year’s profit was spent on reducing debt, which has left upstream operators in a very healthy financial position. The upshot of this is that a significant portion of the vast profits anticipated this year will likely be paid out to shareholders.”

Moreover, Rystad research suggests almost all the large public E&P companies will have an investment ratio between 20% and 30% in 2022.

US independent Occidental Petroleum has the lowest, at about 20%, while US major ExxonMobil is expected to see the most significant increase in FCF in 2022, growing by about $18bn.

Hess is described as an “outlier” with an investment ratio of just 45%, due to its plans to ramp up investments in Guyana and the core US shale patch of the Bakken.

Rystad findings align with other reports that oil and gas giants will spend the bulk of their profits on share buybacks and dividends.

According to data from Bernstein Research, and quoted in the Financial Times, the seven supermajors are on course to return £27.9bn to shareholders, while investment bank RBC Capital put the total at £30bn.

Recommended for you