Offshore contractor Awilco Drilling has secured a short-term, multi-million pound shareholder loan to fund its operations.

Structured as a “draw-down facility”, the loan with Awilhelmsen Offshore and QVT Family Office Fund is for up to $4 million (£3.2m).

An interest rate of 10% per year has been agreed on the total amount.

In addition, there is an arrangement fee of 2% on the loan, which will mature on July 1.

Awilco (OSLO: AWDR) said the cash will be used for “general working capital purposes”.

The Aberdeenshire-headquartered company appointed insolvency experts for one of its subsidiaries earlier this year after losing a £6.8 million case against HMRC.

It had been in a long-running tax dispute with the treasury linked to the termination of a contract for the WilHunter rig in 2015.

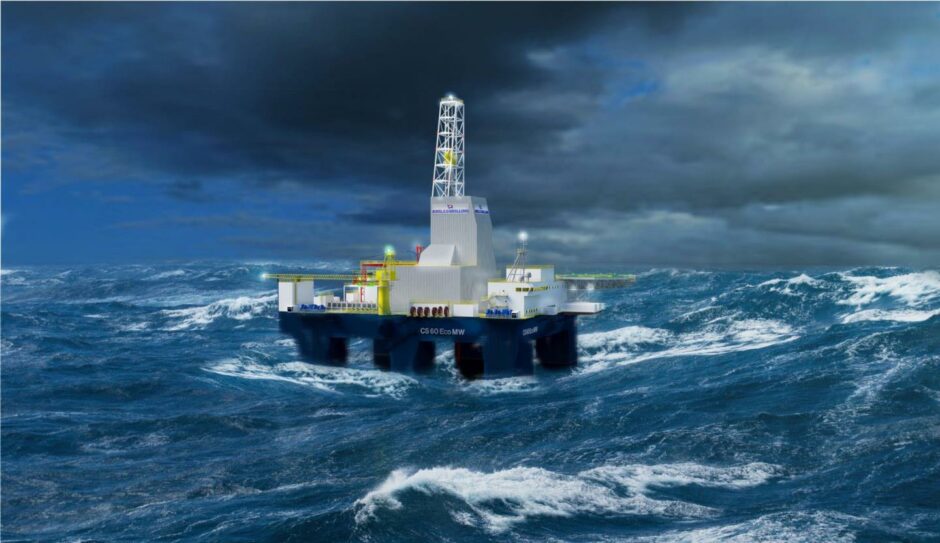

Awilco is also embroiled in hefty legal issues with Keppel Fels over cancelled orders for two new vessels, the Nordic Spring and Nordic Winter.

It has led to heavy arbitration with the Singapore-based shipbuilder, which is demanding a total of £516 million.

Despite securing the loan, the future of Awilco remains in doubt with the company poised to lose its only active asset.

It was announced on Wednesday that decommissioning firm Well-Safe Solutions will buy Awilco’s WilPhoenix rig for £12.4m.

And with the WilHunter on its way to the scrapheap, analysts have said it “could be the end of the line” for the North Sea drilling company.

Awilco said in its 2021 annual accounts that it had 86 offshore crew and 22 onshore staff, but managing director Roddy Smith confirmed to Energy Voice that the headcount is down to around 20 onshore and 20 offshore.

Despite having no foothold in the marker, Mr Smith says there are still options open to the Oslo-listed company.

Speaking after the Well-Safe deal was announced, he said : “We will also continue to closely monitor opportunities in the drilling contracting and well abandonment space and in the event that an attractive investment opportunity is identified, we will make appropriate recommendations to shareholders at that time.”