Statoil has completed a £953million asset swap deal with Wintershall, which will see the German oil and gas producer’s output from the Norwegian continental shelf increase from 3,000 to 40,000 barrels a day.

The massive deal will Wintershall take a 32.7% stake in the Brage field, 30% of the Vega field and a 15% share of the Gjøa field.

In exchange, Statoil will receive $1.35billion and a 15% stake in the Edvard Grieg development in the North Sea.

The move gives the Norwegian oil giant stakes in all four of the Utsira High formation discoveries – Grieg, Gina Krog, Ivar Aasen and the Johna Sverdrup field.

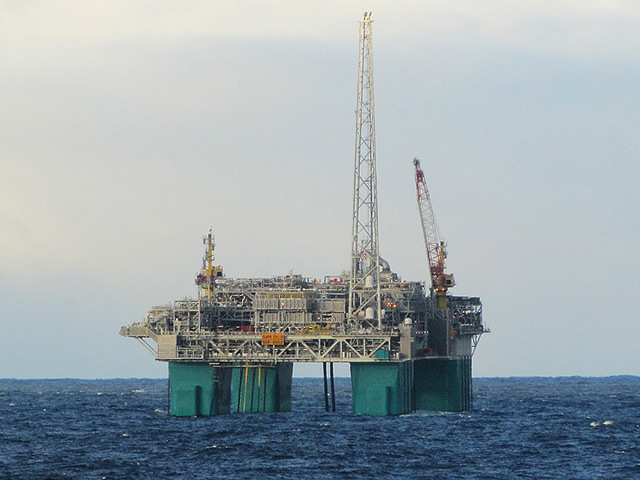

Statoil’s stake in the Gjøa field drops to 5%, while it will retain a 24% stake in the Vega field, while the deal removes any Statoil interest from the Brage field, with Wintershall taking over operatorship of the 25,000boed field, around 120km northwest of Bergen.

“With Brage we will launch a Wintershall-operated production expansion in Norway,” said Bernd Schrimpf, Managing Director of Wintershall Norge.

“That is an important step for us and strengthens our role as a responsible partner for oil and gas in Norway.”

Statoil will continue to provide personnel and assistance on the field for up to 18 months, under the terms of the deal, which takes effect from the end of September.

“The Norwegian continental shelf is, and will continue to be, the backbone of our company,” said Statoil’s Øystein Michelsen.

“By developing new fields and increasing oil recovery, it is our ambition to continue producing more than 1.4 million barrels of oil equivalent per day from the NCS in 2020.

“”We’ve worked well together with Wintershall to ensure that the transfer of operatorship proceeds in a safe and efficient manner.”

Recommended for you