Contractors are buoyant as spending on offshore EPC over the next five years totals $276 billion, a 71% increase compared to the preceding five-year period – according to a Westwood Insight report.

As Europe looks for new gas supplies in the wake of Russia’s invasion of Ukraine, the Middle East, Asia, and Latin America will dominate expenditure.

Westwood report that untapped gas reserves in West Africa are expected to attract investments over the forecast period.

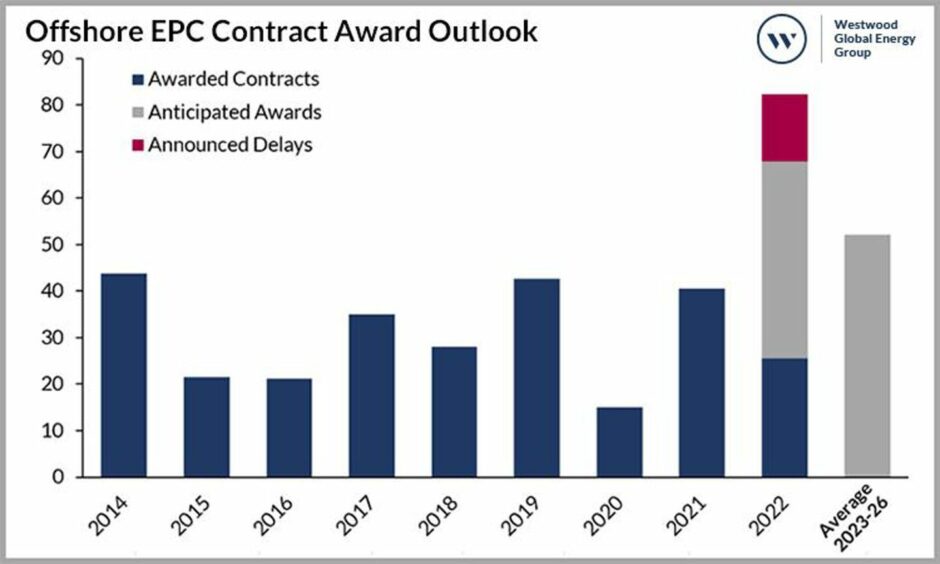

Despite growth in early-stage engagement of the supply chain by E&Ps and a steady increase in the number of pre-sanction projects, the optimism for a bumper year has been tempered.

Westwood’s 2022 offshore EPC contract award value is now estimated to close at US$68 billion, which is 18% lower than its January 2022 outlook.

This decline is due to delays in project sanctioning, as some operators remodel project economics due to supply chain inflationary pressures that could range between 10% to 15% for subsea equipment and production platforms.

That includes the high-profile Rosebank project from Norwegian energy firm Equinor in the West of Shetland.

In April, Equinor confirmed that it was pushing back a final investment decision (FID) on the huge oilfield, which had been expected in 2022, by a year.

Data from Westwood’s SubseaLogix and PlatformLogix market analytic tools shows a sustained upcycle over the 2022-26 forecast period in the absence of any significant shocks in O&G demand

Shelved Projects

Equinor’s Rosebank development has had a final investment decision (FID) and EPC award delayed from 1H 2022.

Based 86 miles from the Shetland Islands, Equinor acquired the operatorship of the Rosebank development in 2019.

Since then, the company has been working to optimise and mature a development solution for the field together with its partners.

When Equinor first acquired the field, it cited similarities with other projects in its global portfolio such as Johan Castberg in Norway and Bay du Nord in Canada.

The Rosebank field was discovered in 2004 and lies in water depths of approximately 1,110m.

Shell’s Linnorm shelved

Shell’s Linnorm in Norway has been shelved indefinitely, as Shell explores alternative development concepts for the field.

In a statement made earlier this year Shell said: “After discussions between the partners, the Linnorm Licence will not continue to further mature a standalone development concept.”

Work was being done on the field as recently as January to design a spar development concept for the field.

It had been hoped that tax incentives would help propel new marginal developments such as Linnorm, which had been put on hold.

Discovered in 2005, the high-pressure, high-temperature (HPHT) gas condensate field lies in licence PL 255 in the Norwegian North Sea, in water depth of around 300 metres.

Recommended for you

© Supplied by westwood energy grou

© Supplied by westwood energy grou