It is nearing crunch time for Awilco Drilling in its long-running dispute with Keppel FELS over the cancellation of two major oil rig orders.

Preparations for the arbitration case against the shipbuilder are continuing, Westhill-headquartered Awilco said, and an outcome could be delivered within in the next year.

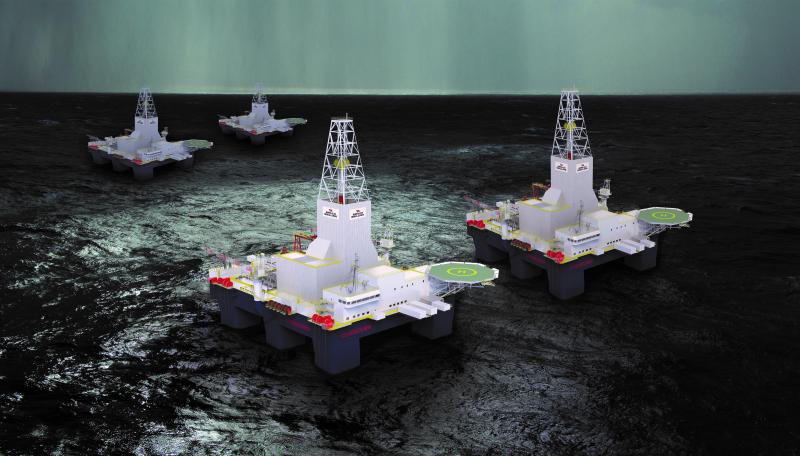

Orders for the Nordic Winter and the Nordic Spring were made in 2018 and 2019 respectively, but were cancelled a couple of years later.

Keppel has lodged statement of claims for $424.9 million for the Nordic Winter, and $268.9m for the Nordic Spring.

Awilco has “strongly denied” the demands and has entered counter-claims of its own.

It is expected that the final arbitration outcome for Nordic Winter will be no earlier than Q4 this year, while the Nordic Spring dispute is expected to wrap up no earlier than Q2 next year.

Awilco pulled the plug on the order for the Nordic Winter in June 2020, claiming a breach of contract, and asked to reclaim its £40m plus interest paid to date. The firm had previously stated slow progress was being made by the shipbuilder in Singapore.

Steel was cut on the Nordic Spring in the third quarter of 2019 and contractual delivery was meant to be in March 2022.

Keppel issued Awilco with a notice of cancellation in December 2020, claiming Awilco would not be able to make its second instalment payment, due three months later.

Both rigs have since been taken up by Dolphin Drilling, whose headquarters are also in Aberdeen.

Awilco published its second quarter results for 2022 on Tuesday.

In the first half of the year it made no revenue, having sold its only operational asset, the WilPhoenix, to Well-Safe Solutions.

Meanwhile the sale of WilHunter for environmentally responsible recycling in Turkey was concluded on June 22.

Operating loss for H1 2022 was $11.5m and analysist have speculated that the end could be nigh for Awilco, which has 12 Aberdeen-based employees.

At the end of the second quarter, the company had a cash balance of $10.5m and no outstanding debt.

A short-term shareholder loan of $4m with Awilhelmsen Offshore and QVT Family Office Fund was redeemed on June 9.

If both arbitration cases with Keppel run to their current timetable, Awilco says the remaining costs may exceed its current cash balance.

If new funding is necessary, the company expects it to be required by October 2022, and potential financing alternatives are being explored.