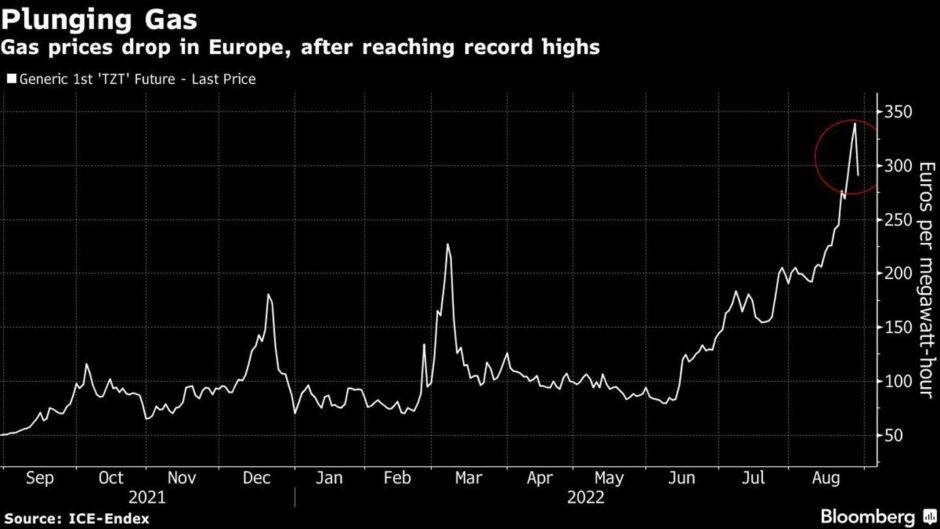

European natural gas prices plunged the most since March after Germany said its gas stores are filling up faster than planned.

Benchmark Dutch front-month futures fell as much as 21%, partly reversing last week’s jump of almost 40%. German power prices also slumped, after earlier climbing to a record. In Germany, gas stores are filling up fast and are expected to meet an October target of 85% full already next month, Economy Minister Robert Habeck said in a statement on Sunday.

Monday’s plunge in prices is some relief after a furious rally with futures still trading almost six times higher than a year ago. The region is on the brink of a recession, with inflation at the highest in decades in some countries. Governments are also putting in place measures to ease the burden, setting aside some 280 billion euros ($278 billion) in relief packages.

The fundamental picture still looks bleak, and even with full storage sites, Germany risks not being able to go through the winter if Russia halts flows to the region’s largest economy. The Czech Republic, which holds the European Union’s rotating presidency, will call an extraordinary meeting of energy ministers to discuss bloc-wide solutions.

Germany to Reach October Gas-Storage Target Already Next Month

While there is uncertainty over whether the Nord Stream pipeline will resume flows after maintenance later this week, Goldman Sachs Group Inc. said the recent huge price moves are partly down to very low liquidity.

“European gas prices have in our view overshot fundamentals fueled by a combination of supply and demand concerns and exceptionally poor liquidity in the market,” Goldman Sachs said in a report late on Friday. “Northwest European gas demand has realized above our forecast, this has been offset by higher-than-expected supply, keeping storage builds in line with our expectations.”

With more gas in storage, European nations are slightly better placed to face a further supply cut as Russia’s Gazprom PJSC starts maintenance on Nord Stream on Wednesday. Lower temperatures seen across Eastern Europe, and parts of the Iberian peninsular next week will also help nations to reserve more gas as less energy is seen to be needed for cooling.

Engie SA’s EnergyScan unit said on Monday that prices are probably also dropping on profit taking. Prices gained for six consecutive weeks through Friday. The low liquidity in general is exacerbated by the UK bank holiday on Monday.

“The closer we get to the total filling of gas stocks — on 27 August, EU stocks were 79% full — the more the bullish momentum will be challenged,” the market analysis unit said.

For the moment, demand destruction is gaining pace as the supply crunch is hurting industries across Europe. Fertilizer companies are being especially affected, with more than two-thirds of production capacity halted by soaring gas costs, according to Fertilizers Europe, which represents most of the continent’s producers.

The crunch has triggered increasing action to reduce consumption, with Europe targeting a 15% cut in gas use this winter. European governments have started to take the drastic step of limiting energy use, such as banning outside lighting for buildings and lowering indoor heating temperatures. Germany’s economy minister proposed a reform in power markets so that prices are no longer coupled to the most expensive supplier.

Meanwhile, pipeline supplies into Europe from Norway have fallen about 20% this month as planned and unplanned outages exacerbate the crunch. Competition for LNG cargoes has also increased amid restricted supplies.

The price of benchmark German power for next year slumped 19%, after earlier climbing to a record 1,050 euros a megawatt-hour. The region’s power benchmarks have been setting records on an almost daily basis, with prices in Germany and France surging more than 25% on Friday.

The German power market “just keeps on rallying to new extreme price highs every day due to a full-scale panic about what the upcoming winter will bring,” analysts at trading firm Energi Danmark said in a note on Monday.

Dutch gas futures for next month slumped 18% to 279.35 euros per megawatt-hour at 1:58 p.m. in Amsterdam.

© Supplied by Bloomberg

© Supplied by Bloomberg