Private equity firm Bluewater has taken full ownership of Aberdeenshire subsea robotics company Rovop.

But it will be business as usual at Rovop, which is headquartered in Westhill, after investor BGF sold its seven-year-old stake to London-based Bluewater for an undisclosed sum.

Rovop chief executive Neil Potter said the BGF-Bluewater deal “does not, in any way, impact the day to day activities of the business”.

There is “zero impact on the workforce”, he added.

Firm employs 250 people worldwide

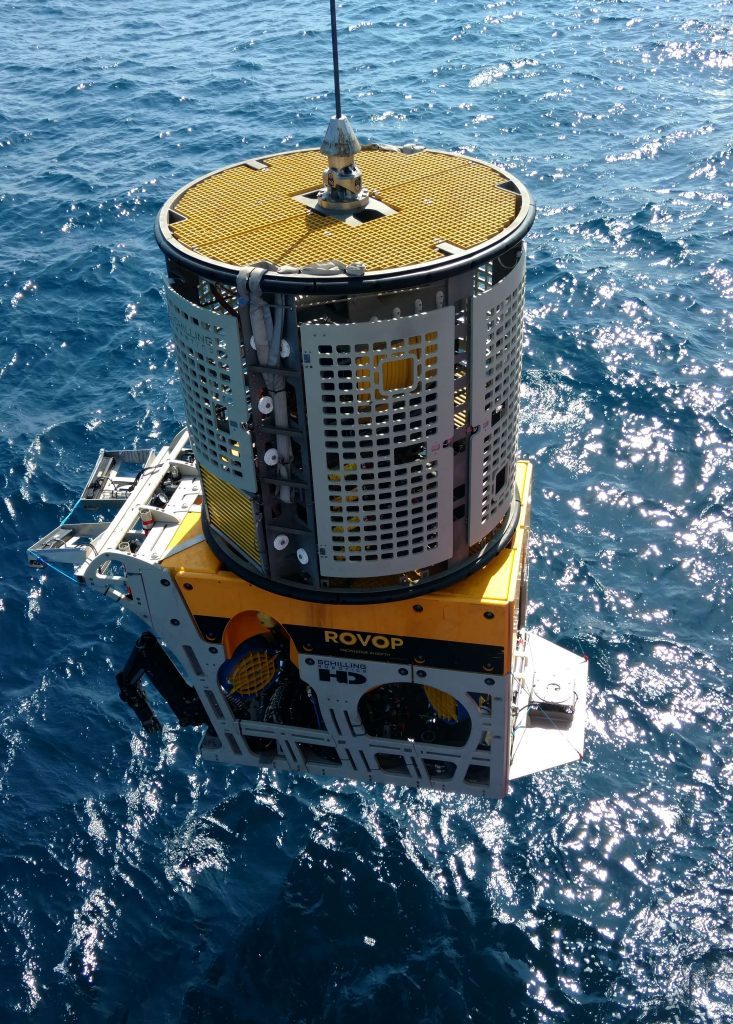

Founded in 2011, Rovop specialises in underwater robotics and operates in the oil and gas, offshore wind and utilities industries globally.

In its accounts for the 18-months to March 31 2021, the subsea services firm reported a narrowing of pre-tax losses to £9.5 million from £22.6m in the previous 12 months.

Revenue grew to £46.6m in the latest period, up £36m previously.

The company employs about 250 people in operations spanning Europe, the Middle East, North Africa, Asia-Pacific and the Americas.

An onshore team of around 70 workers supports an offshore team of about 180.

Mr Potter said the workforce was building up steadily, reflecting activity levels and new contracts.

He added: “It has been a positive couple of years for Rovop and during this period the growth support from our investors has been of significant benefit.

“Looking forward, aligned with the positive trajectory of the sector, we have strong utilisation, growing backlog and a number of key established relationships – which positions Rovop well as we head into 2023.”

It has been a positive couple of years for Rovop.

Neil Potter, chief executive, Rovop.

Bank-backed BGF – formerly the Business Growth Fund – invested £10m in Rovop in 2015.

The cash injection helped the firm pay off the £5m it was lent in 2012 by the Scottish Loan Fund, which was set up by the Scottish Government to support firms having difficulty accessing traditional bank finance.

BGF and Bluewater sank a further £56m into the business in 2017.

Rovop completed a refinancing in July 2020, comprising a cash injection of £5m from Bluewater and BGF, alongside a “major secured creditor”, as well as debt restructuring to stabilise the business.

Seven-year itch

Commenting on the stake sale to Bluewater, BGF investor Richard Pugh said: “This marks the end of a seven-year partnership with Rovop and its management team.

“BGF supported the investment in new equipment and technology, in a world-class training facility, and in new facilities in the Middle East and America.

“These developments were also supported by further investment from Bluewater in 2017.”

Mr Pugh added: “We have worked together to grow the business and position it as a leading global provider of subsea services across both oil and gas and renewables markets.

“We wish Rovop’s management and Bluewater every success as they continue this investment programme.”

Recommended for you