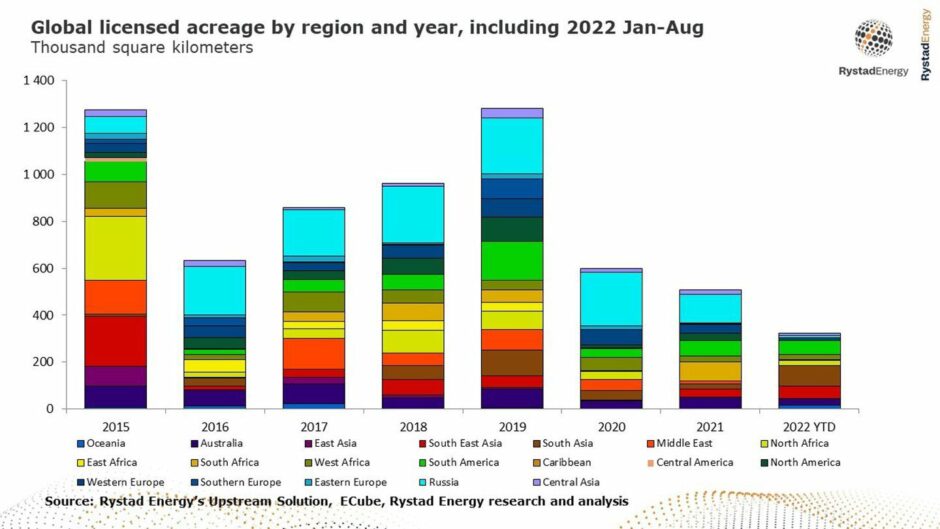

Global oil and gas exploration will cool this year as the number of licensed blocks and total acreage fall to “near all-time lows” according to findings by Rystad Energy.

The Oslo-based analysts reported last week that just 21 leasing rounds were completed worldwide as of the end of August 2022 – half the 42 rounds held in the first eight months of 2021.

The acreage awarded has also shrunk, with a 20-year low of 320,000 square kilometres having been offered.

All told, the group expects a total of 44 lease rounds to be held by the end of the year, 14 less than in 2021 and the lowest level since 2000.

The decline marks a change in the appetite of both exploration and production (E&P) firms and politicians.

Spending by oil firms has dropped as they look to reduce risk and limit spending to ensure resilience, while many governments have paused or halted the issuing of new leases amid wider efforts to limit the expansion of new fossil fuels.

Last year the International Energy Agency (IEA) said no new oil and gas fields were needed in its pathway to meet net zero emissions by 2050, and that no new investments in fossil fuel projects should be made as of its May 2021 announcement.

“Global exploration activity has been on a downward trend in recent years, even before the Covid-19 pandemic and oil market crash, and that looks set to continue this year and beyond. It is clear that oil and gas companies are unwilling to take on the increased risk associated with new exploration or exploration in environmentally or politically sensitive areas,” noted Rystad VP of upstream analytics Aatisha Mahajan.

Asia bucks trends

Onshore exploration in particular has seen decline, with the acreage awarded dropping from around 560,000 square km in 2019 to 115,000 square km so far this year.

Meanwhile offshore acreage hit a high point in 2019 before collapsing in 2020, and has plateaued over the past two years.

Concluded lease rounds have dropped significantly in Russia, the US and Australia this year.

These countries have held a total of five lease rounds so far – three in Russia and one each in the US and Australia – compared with 17 rounds in the first eight months of 2021.

The drop in the US is primarily driven by the cancellation of Lease Sales 259 and 261 in the Gulf of Mexico and Cook Inlet in Alaska.

However, Asian licensing has “bucked the trend”, analysts noted, with increased activity and blocks awarded in Malaysia, Indonesia, India and Pakistan. Yet the global decline has still directly affected the acreage on offer, which hit an all-time low for the January to August period of about 320,000 square km.

Even Russian acreage has fallen 90% from one year ago to 9,000 square km, while that offered in Africacan nations has fallen 70%, to just 46,000 square km in Angola, Egypt, Morocco and Zimbabwe – the only countries on the continent to award new exploration in 2022.

Conversely, new acreage awarded in Asia between January and August nearly quadrupled from the same period last year, while South American awarded acreage surged by 140%.

Brazil led the pack with a total of 59 block awards spread across onshore and offshore acreage.

Norway also awarded 54 new licenses in its APA 2021 round, India with 29 blocks its OLAP Rounds 6 & 7, and Kazakhstan’s fourth oil and gas auction round, in which 11 blocks were awarded.

Rystad noted “sporadic activity” in Africa between January and August, in which Egypt awarded rights to explore in nine blocks and Angola two blocks.

Yet the UK may yet buck the global trend, with new PM Liz Truss predicting this week that more than 100 licences could be awarded as her new government rushes to launch a new award round by October.

Meanwhile North Sea Transition Authority (NSTA) chief executive Andy Samuel suggested the regulator would take a new approach to the 33rd Licensing Round, the sector’s first since 2020, which will see it prioritise approvals by the speed at which they could be developed.

Recommended for you

© Supplied by Rystad Energy

© Supplied by Rystad Energy