Most of Europe has been brutally winded by the energy shortage currently plaguing the continent.

Sanctions on Russian oil and gas following the Kremlin’s invasion of Ukraine have brought a number of long standing issues – such as underinvestment and low storage – to the fore.

From Italy to Iceland, governments are working to secure energy supplies and to soften the blow of mounting bills on households.

And while a lack of energy and rising costs is a continent wide problem, it is something the UK has been particularly susceptible to, and bills have soared ahead of comparable countries in Europe.

Just a couple of days into the job, Prime Minister Liz Truss was forced to step in, announcing a £2,500 a year cap on bills for the next two years.

On the whole the intervention was welcomed with open arms, but recent months have caused people in the UK to question why they are paying more than their closest neighbours.

Exposure to gas

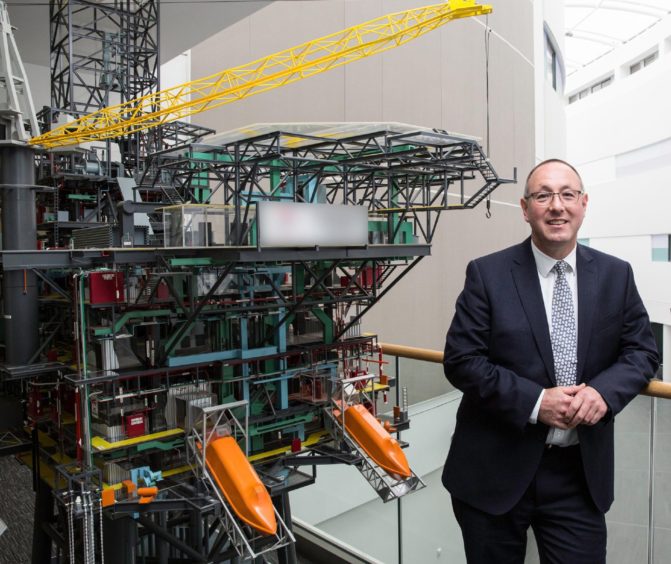

“History is a good guide for the future here,” said Professor Paul de Leeuw, director of the energy transition institute at Robert Gordon University.

“Over the last few decades, the UK has been relying more heavily on natural gas for heating and electricity generation than its European neighbours.

“Currently over 44% of all the electricity in the UK is generated by gas-fired power stations.

“This compares to around 22% across the EU, where nuclear and renewables play a bigger part in the generation mix.”

In the last year the wholesale price of gas has skyrocketed by more than 400%, driven by less supply from Russia, more demand from Asia, and low wind speeds.

Storage

The UK’s high dependency on the fuel means it has felt the sharp edge of this shortage, and a lack of options for storing the fuel has made the crisis even worse.

Professor de Leeuw said: “Compared to our European neighbours, the UK has very limited gas storage capacity (up to 5 days versus up to 90 days in Germany).

“This makes the UK more dependent on accessing gas in the short-term markets and therefore more exposed to price volatility.”

It is an issue Westminster is trying to address, and Centrica is close to reopening the North Sea Rough gas storage field, which shut in 2017.

If everything goes to plan, fuel could start to flow into the facility imminently, providing a welcome buffer as winter creeps nearer.

Market reform

Storage is just one piece of the puzzle though, and Professor de Leeuw believes “fundamental market reform” is needed to bring down electricity prices in the long run.

In recent years the UK has consistently multiplied its renewables sources, but a flaw means low cost renewable energy isn’t as cheap as it should be.

Professor de Leeuw said: “UK electricity prices are determined – every 30 minutes – by the cost of the last unit of energy acquired to meet the UK’s electricity demand and the electricity required to balance the grid.

“Most of the time, the marginal electricity required is generated by using gas-fired power stations.

“This means lower-cost renewable energy is sold at the same price as more expensive fossil fuel-generated electricity. It also directly links the cost of electricity in the UK to the rocketing and often highly volatile spot market for gas, which has a disproportionate impact on UK electricity prices.”

Decoupling

Ms Truss has already pledged to decouple the price of green energy from gas by bringing renewable projects that went live before 2015 onto Contracts for Difference (CfD).

The long-term deals guarantee developers a fixed price for their power; if the market rate drops below that level, the government will cover the difference, and vice versa.

Professor de Leeuw said: “By decoupling electricity prices from gas prices, the UK will be able to price electricity closer to the actual costs of electricity generation.

“Inevitably this will be a complex and time-consuming process, but the prize for the consumer will be lower and more predictable utility bills.

“This will be a smarter, cheaper and greener way to manage the cap in the long term and should be a ‘win-win’ for all.”

Read Professor de Leeuw’s full article on gas prices and the need for market reform here.

Recommended for you

© Yui Mok/PA Wire

© Yui Mok/PA Wire © SYSTEM

© SYSTEM © Centrica Storage

© Centrica Storage © EVENING EXPRESS

© EVENING EXPRESS