The North Sea Transition Authority (NSTA) recommends focusing on second wellbores, maintenance and licensing rounds to boost UK North Sea investment.

The NSTA’s recent Wells Insight Report found that drilling activity remained low in 2021, as the industry continued its recovery from the impact of the COVID-19 pandemic,

It made a series of recommendations to improve performance and noted that a focus on second wellbores, the impact of its new licensing round and maintaining existing wells could all help boost production in years to come.

However, some operators are facing logistical constraints on platforms or problems with their supply chains.

NSTA head of technology Carlo Procaccini said: “Amid the energy crisis, it is vital that North Sea industry works quickly to secure additional supplies of oil and gas, produced as cleanly as possible. That means drilling more new wells and restoring those which can be repaired.

“The NSTA is working with industry on a number of fronts to support this work. Part of that involves sharing data, such as those presented in this report, and benchmarking to keep industry better informed on wells performance and priority areas.”

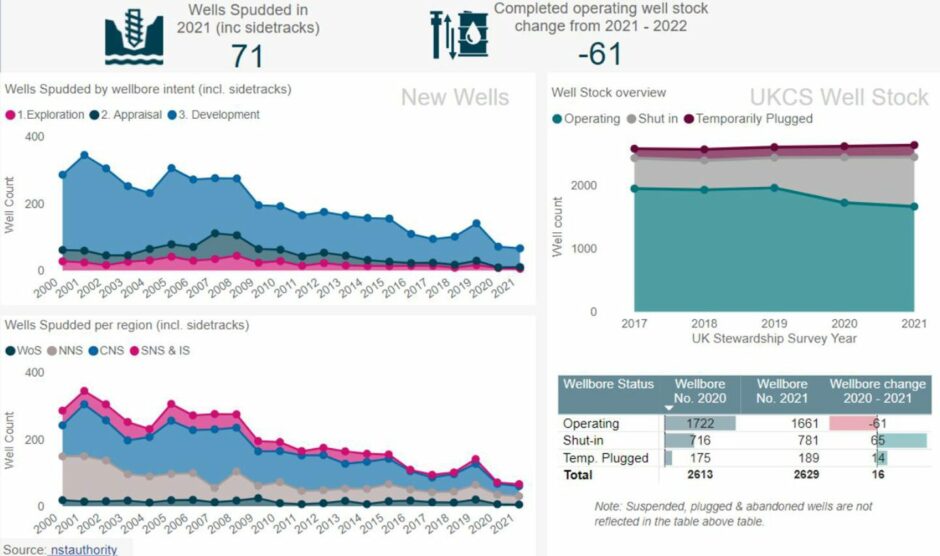

The report finds that the number of UK North Sea exploration and appraisal (E&A) wells spurred per year has been declining over the last decade.

10 such wells were spudded in 2021 – up from nine in 2020, but still one-third of the 29 completed in 2019.

Sixteen high-probability E&A wells are planned in 2022.

At the same time, the number of operating wells is also falling with more than one-third of the stock either temporarily plugged or shut in.

Without restoration work being performed on these wellbores, they are unlikely to be returned to operation and will likely be permanently abandoned, leaving reserves stranded.

The impact can been seen in the basin’s production, which fell to 480 million barrels in 2021, compared with 600 million in 2019.

The report found that drilling operations were taking place in 141 wells in 2019, that number dropped to 66 wells, including five exploration, five appraisal and 56 development wells, last year.

The figures from 2021 correlate with the year previous, according to the NSTA.

Surveillance levels increased to 25% last year from 21% in 2020 while intervention-based surveillance remained low at 4%, far below the 50% target recommended by the North Sea Transition Forum’s Wells Task Force.

However, the report found that the high price of oil this year has led to accelerated development of 30 projects which target 1.5 billion barrels of oil, the report noted.

As of the end of 2021, only 49 wells were planned for 2022,but the NSTA notes that a rebound in drilling activity is likely to see more planned in 2023, while high commodity prices help firm up development approvals.

Encouragingly, development is also taking less time, with half of the 66 previously mentioned wells targeting near-infrastructure opportunities with a quick turnaround time.

One of the developments in question, located in a well-developed area, came onstream at the beginning of this year, smashing the average discovery to production timescale of five years.

Recommended for you

© Supplied by NSTA

© Supplied by NSTA