Low-emissions drilling rigs are commanding “premium dayrates” as contractors seek to slash their operational footprint.

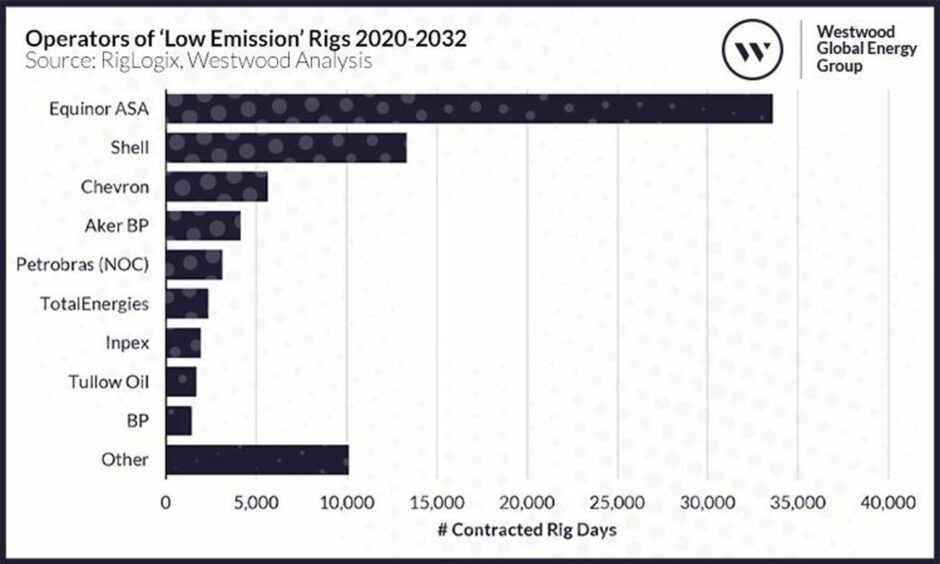

Research published by Westwood Global Energy Group shows a ‘healthy demand’ for such assets, spearheaded by Norwegian energy giant Equinor (OSLO: EQNR).

It also finds that while the availability of emission-lowering upgrades for offshore rigs has been on the rise, adoption has been slow outside of Norway and the US Gulf of Mexico.

That is due to limited regulatory and financial incentives.

Westwood’s research reveals that the biggest users of rigs fitted with emission reduction technology are those with ambitious emission goals of their own, largely driven by Equinor’s Norway and Brazil operations.

Between 2020 and 2032, the state-owned company’s contracted days of low-emissions drilling rigs is 33,618 (92 rig years).

The combined number of days for all other operators is 43,600 rig days (119 rig years).

As a result of Europe’s energy crises, 2022 has heralded an increase in jackup, semisubmersible and drillship demand, utilisation, and dayrates – they have all reached highs not seen since 2014.

Westwood anticipates further increases through to 2026, meaning emissions from the offshore drilling fleet, if unimpeded, will rise as more units are put to work.

Teresa Wilkie, RigLogix Director, Westwood, said: “Drilling contractors, and the industry as a whole, are starting to realise that oil and gas will be imperative to energy security over the coming years.

“But that doesn’t need to come at the detriment of the energy transition. Rig operators have ambitious scope 1 reduction targets, and eco-friendly rig technology is keeping pace. The next step is for regulators to work with the industry to ensure that the framework is there to facilitate adoption of these new technologies in a financially sustainable way.”

She added: “Norway is dominating as the biggest user of low-emission rigs, driven by the country’s carbon taxation regulations as well as incentivisation. Pair this with Equinor’s ambitious emission reduction targets and you have a ripe environment for low-emission rig adoption.”

Since the industry downturn in 2014, new build rig orders have almost come to a halt due to lack of demand and a mass oversupply of rigs.

It has led to a resulting stack of state-of-the-art rigs being left abandoned in shipyards with no work.

Despite the bounce back in drilling, there is still a lack of appetite to invest in costly new builds and therefore a deluge of “green” rig orders is unlikely, Westwood said.

Instead, it is expected that more of the current fleet will be retrofitted for lower emission operations.

Ms Wilkie said: “Some drilling contractors are at the beginning of their emissions reduction journeys, while others have been working on emission-reducing technologies, projects, and studies for several years. By amalgamating the industry’s different and increasing efforts regarding this complex topic, we can better understand the trajectory of the industry, highlight new technologies and identify the areas of opportunity.”