Exxon Mobil, Chevron, Shell, TotalEnergies and BP reaped almost $200 billion collectively last year but fears of an economic slowdown, plunging natural gas prices, cost inflation and uncertainty over China’s re-opening are dimming the outlook for 2023.

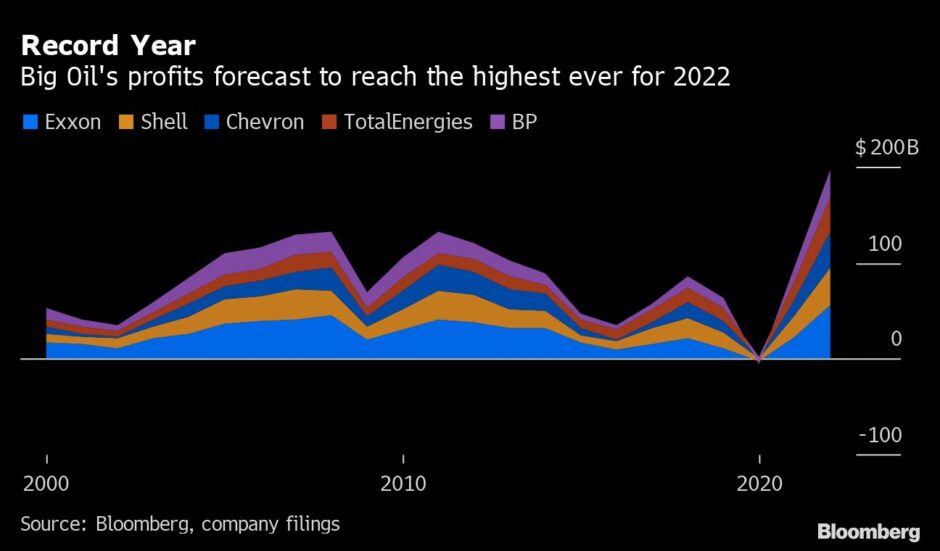

The five companies are expected to report $198.7 billion in combined 2022 profit in coming days, 50% higher than the previous annual record set more than a decade ago, according to data compiled by Bloomberg.

The tsunami of cash generated by the group over the past 12 months means the industry can sustain dividend increases and share buybacks, analysts said. Crucially for shareholders, management teams held off on spending increases as commodities boomed, in stark contrast with previous cycles.

Instead, they opted to repay debt and swell investor returns: Chevron stunned shareholders with a $75 billion stock-repurchase announcement on Wednesday — five times the company’s current annual outlay for buybacks.

“Commodity prices are down across the board relative to record 2022 levels, but it still looks like it’s going to be a very strong year,” said Kim Fustier, head of European oil and gas research at HSBC Holdings Plc. “It could very well be the second best year in history for overall distributions and share buybacks.”

Fourth-quarter earnings, while one of the three highest on record, will likely be reduced by lower oil and gas prices. Guidance from Exxon and Shell suggest refining margins held up more than expected. Chevron is scheduled to kick off Big Oil earnings season at 6:15 a.m. New York time on Jan. 27.

While the pullback in energy prices has been sharp — crude and gas are lower now than when Russia invaded Ukraine in late February — it may help put the global economy and energy companies on a firmer long-term trajectory. Lower energy costs are helping take some of the sting out of inflation, easing pressure on central banks to carry on raising interest rates.

Across the board, the biggest oil explorers are focused on funneling record profits back to shareholders while keeping a check on spending. That strategy has provoked political attacks from Brussels to Washington DC by politicians wanting more supply to bring down prices.

Shares of the five supermajors are up at least 18% since Russia’s invasion despite an 11% drop in the price of crude. The top ten performers in the S&P 500 last year were all energy companies, with Exxon advancing 80% for its best annual performance on record. Oil companies now generate about 10% of the index’s earnings, despite making up just 5% of its market value, according to data compiled by Bloomberg.

“Investors are attracted to a lot of the characteristics this sector has to offer now,” said Jeff Wyll, a senior analyst at Neuberger Berman Group LLC, which manages about $400 billion. “It was trying to be a growth sector and that failed. It reinvented itself as a cash distribution and yield play, which is attractive in this environment.”

Key to the oil majors’ fortunes is whether they can stick to shareholder-return pledges made last year during the months-long run up in commodity prices.

“I expect them to maintain those shareholder returns,” said Noah Barrett, lead energy analyst at Janus Henderson, which manages about $275 billion. “The base dividends are incredibly safe at almost any oil price, balance sheets are in good shape and I expect them to continue buying back shares.”

Investors are also keen to hear executives sticking to the mantra of capital discipline. It was the huge growth in spending over much of the last decade that eroded shareholder returns and left the sector vulnerable to oil crashes in 2016 and 2020.

“There is still an aversion to big capital expenditure increases, period,” Wyll said. “The problem the sector got into in the past is doing too many megaprojects at one time. Now it’s much more focused.”

So far that discipline appears to be holding. Exxon and Chevron both raised spending targets for this year but the increases were driven largely by inflation rather than ramping up long-term growth projects. Despite a 500% increase in oil prices from early 2020 to mid-2022, global oil and gas capital spending fell in real terms, Goldman Sachs Group Inc. said in a Jan. 9 note.

One crucial question for executives this earnings season is how much they’re reserving for European windfall-profit taxes. Exxon estimated a $2 billion charge, but is pursuing legal action. Shell says its 2022 bill may total $2.4 billion.

Earlier this month, Exxon indicated that fourth-quarter earnings took a hit of about $3.7 billion from weaker oil and gas prices compared with the previous quarter, but analysts noted that refining margins were much stronger than expected. The US oil giant reports on Jan. 31.

Shell, whose newly-appointed Chief Executive Officer Wael Sawan will host his first earnings call, also noted stronger refining and pointed to a rebound in gas trading. TotalEnergies pointed to similar trends in a Jan. 17 statement.

Recommended for you