A recent study has found that the UK’s most googled stock is the energy major BP (LON: BP), the firm was searched more than Rolls Royce (LON: RR).

The study, by UK financial services provider CMC Markets, analysed Google search data for over 250 top UK stocks in every European country.

There are over 650,000 searches for BP stock in the UK every month, the research shows, this makes up one-fifth of the UK’s stock market googling.

However, despite being the top stock search in the UK, BP did not rank number one anywhere else in Europe.

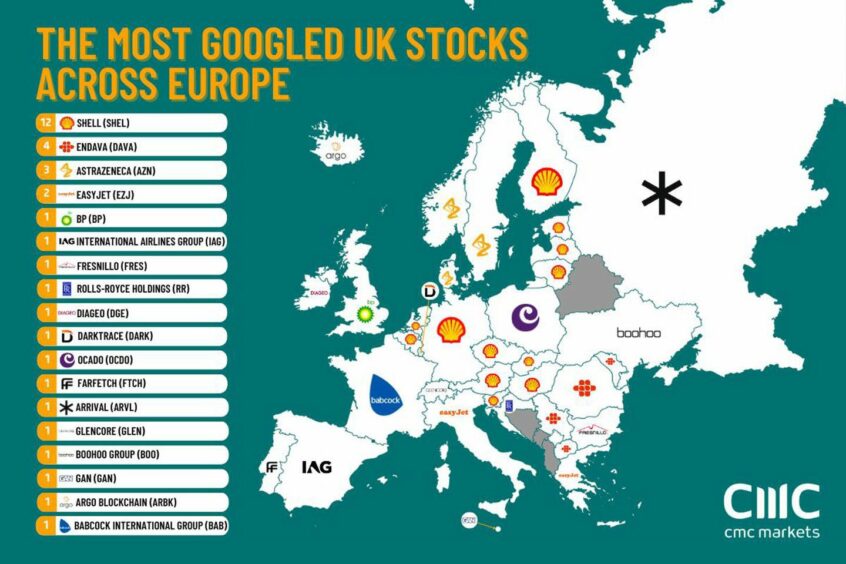

The data found that Shell was googled the most in 12 countries making it the most popular search for UK stocks across the continent.

This comes as both Shell and BP have posted record-breaking annual profits with the firms posting pre-tax earnings of $64.8 billion and $27.7bn respectively in 2022.

Shell (LON: SHEL) was shown to be the top result in Belgium, Netherlands, Finland, and Germany with searches for the energy major’s shares making up over 1 in 50 average monthly global searches for UK stocks.

The analysis revealed that Shell and BP were most searched in almost two-fifths of Europe, making UK oil and gas sector stocks the “most searched by far”.

Technology firms were also well represented in searches for UK Stock across Europe with software developer Endava being named the second most Googled UK stock in Europe.

The Software developer was the top result in four countries with Romania’s being the most interested with 10,750 monthly searches for Endava stock in the country.

A spokesman from CMC Markets said: “There are over 16.6 million estimated monthly searches for UK stocks worldwide, with just over one in four searches coming from outside the UK.

“These findings highlight Shell’s European reach and popularity as a publicly traded company. The high search volume for these stocks indicates strong consumer interest in oil and gas and technology companies and their financial performance.

“It is also worth noting that the average monthly search volume for these stocks indicates consumer sentiment toward the stock. Investors should take note of the highest profile companies in each country, as this may indicate strong potential for growth.

“The study provides valuable insight into consumer sentiment toward UK stocks among its neighbours. The findings of the study can help investors make more informed decisions when it comes to investing in UK stocks”.

Recommended for you

© Supplied by CMC Markets

© Supplied by CMC Markets