Engineering and project management giant Amec is thought to be eyeing a takeover of Swiss rival Foster Wheeler.

A successful deal between the two firms would create a £5billion-plus energy service company.

It comes just three months after Amec – which provides services and equipment for the oil and gas, mining, nuclear and renewable energy sectors – had a £690million takeover bid rejected by global engineering group Kentz.

Amec is now looking at Foster Wheeler among a number of potential acquisition targets but is not currently in talks, sources said yesterday.

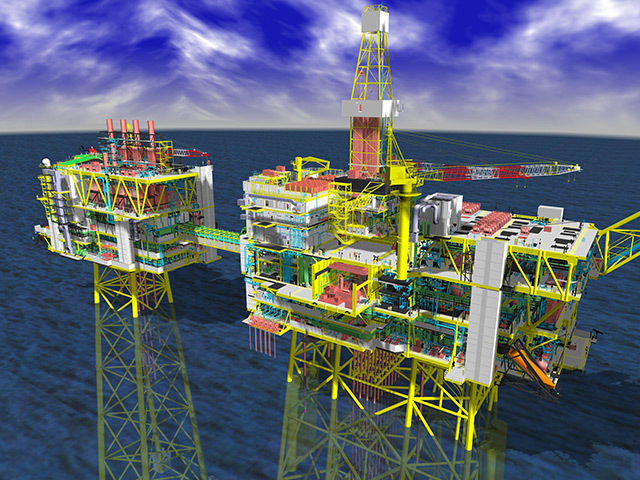

A spokesman for Amec, whose current projects include work on BP’s £4.5billion Clair Ridge development west of Shetland, said the company did not comment on market rumours.

Foster Wheeler did not return calls seeking comment.

Amec – worth more than £3.4billion – employs about 29,000 people, including around 4,000 in Aberdeen and the North Sea, in 40 countries.

Foster Wheeler has a market value of about £1.7billion. Services cover engineering, procurement and the supply of power equipment. It has several bases in the UK, including in Aberdeen and Reading.

The two companies already work together after recently securing consultancy contracts in Kuwait for the building of a new refinery.

Amec chief executive Samir Brikho has offered to distribute cash to shareholders if he does not carry out a big acquisition by the end of this year.

An interim management statement from the firm last week said it was on track to meet 2013 guidance, boosted by strong performances in the UK North Sea and Gulf of Mexico.

It had previously forecast low-to-mid single-digit growth across the group.

Amec did not give a forecast for revenue or profits last week, but analysts are predicting £344million in earnings before interest, tax and amortisation on revenue of £4.1billion for 2013.

In August, Kentz rebuffed Amec’s takeover approach – the second from the company – and a lower offer from Denmark’s M+W Group, saying it undervalued the business.

Recommended for you