The global remotely operated vehicle operations expenditure market for 2013 through 2017 is forecast to grow to around $9.7billion, an increase of 79% over the previous five-year period ($5.4billion).

This suggests the next few years will bring a bonanza to ROV builders, including in Aberdeen.

Researchers at Douglas-Westwood calculate that global demand for ROV support may reach almost 691,000 days over the forecast period 2013-2017, compared to 487,000 days over the preceding period, a growth of 42%.

The rate of increase in expenditure is forecast to be higher than the rate of growth in ROV days. This is due to oil and gas producers moving towards deeper water and more complicated development programmes, thus demanding higher specification vehicles to cater for their needs.

DW forecasts strong growth in annual expenditure from about $1,6billion this year to $2.4billion in 2017, an increase of 47%.

Drilling support expenditure accounts for 75% of the total over 2013-2017 and is expected to rise over the period by 13%. Expenditure on construction support accounts for 20% of the total, increasing by 22% and repair & maintenance spending for 4% of said total, rising by 22% over the period.

Drilling support will be the driver behind the majority of requirement for ROVs over the five-year period; indeed the forecast is for almost 527,000 days of ROV demand, 76% of the total 691,000 days forecast market.

DW says that, more specifically, it is exploration & appraisal (E&A) wells that will account for the majority of ROV activity over the forecast, accounting for 56% of total ROV days.

In terms of construction support ROV days, template, manifold, flowline and jumper (TMFJ) installations will be the main source of demand. DW forecast just over 62,000 ROV days are required to support TMFJ installations, 46% of the total construction support days during this period.

Turning to global ROV supply, DW says the current fleet of work-class ROVs comprises 1,102 units operated by 25 companies. Oceaneering dominates with 316 ROVs in its fleet.

Picking through prospects in regional terms, Africa is expected to top the demand league table.

Africa is forecast to experience strong demand from subsea development wells and will remain the largest region globally, requiring over 154,000 ROV days throughout the period to 2017. Africa is also forecast to be the largest expenditure market with a total spend through the period 2013-2017 of $2.4billion.

Latin America is ranked second at $2billion while Asia is third at $1.4billion.

The Middle East has the lowest ROV spend; it is forecast at just $193million… an increase of 5% over the previous period.

By contrast, Latin American ROV expenditure grows the most; increasing by 139%.

However, ROV expenditure is set to decrease over the period in both Norway and the Middle East. They are also expected to see a decrease in ROV days.

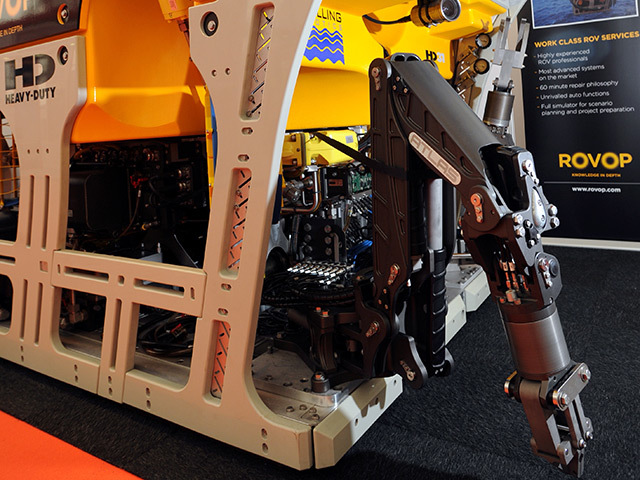

DW suggests that, as oil companies look to increase the profitability and efficiency of their subsea developments, there will be a surge of demand for exceptionally powerful work-class ROVs, able to perform the support work needed in an industry where new technologies and processes are vital.

Indeed, the move to ever deeper waters will drive demand for work-class vehicles and manufacturers will have to produce high specification models capable of performing at greater depths.

It is thought that smaller manufacturers may find there are opportunities to move from the production of inspection class and light work-class ROVs into the market for heavy-duty work-class units.

Because the market outlook is so buoyant, DW also sees new entrants to the ROV fleet operator market.

However, it won’t be easy as the top 10 operators currently claim a total market share of around 84%; the top three commanding almost 60%.

Notwithstanding the possibility of new entrants, DW sees scope for further market consolidation.

The global remotely operated vehicle operations expenditure market for 2013 through 2017 is forecast to grow to around $9.7billion, an increase of 79% over the previous five-year period ($5.4billion).

This suggests the next few years will bring a bonanza to ROV builders, including in Aberdeen.

Researchers at Douglas-Westwood calculate that global demand for ROV support may reach almost 691,000 days over the forecast period 2013-2017, compared to 487,000 days over the preceding period, a growth of 42%.

The rate of increase in expenditure is forecast to be higher than the rate of growth in ROV days. This is due to oil and gas producers moving towards deeper water and more complicated development programmes, thus demanding higher specification vehicles to cater for their needs.

DW forecasts strong growth in annual expenditure from about $1,6billion this year to $2.4billion in 2017, an increase of 47%.

Drilling support expenditure accounts for 75% of the total over 2013-2017 and is expected to increase over the period by 13%. Expenditure on construction support accounts for 20% of the total, increasing by 22% and repair & maintenance spending for 4% of said total, rising by 22% over the period.

Drilling support will be the driver behind the majority of demand for ROVs over the five-year period; indeed the forecast is for almost 527,000 days of ROV demand, 76% of the total 691,000 days forecast market.

DW says that, more specifically, it is exploration & appraisal (E&A) wells that will account for the majority of ROV activity over the forecast, accounting for 56% of total ROV days.

In terms of construction support ROV days, template, manifold, flowline and jumper (TMFJ) installations will be the main source of demand. DW forecast just over 62,000 ROV days are required to support TMFJ installations, 46% of the total construction support days during this period.

Turning to global ROV supply, DW says the current fleet of work-class ROVs comprises 1,102 units operated by 25 companies. Oceaneering dominates with 316 ROVs in its fleet.

Picking through prospects in regional terms, Africa is expected to top the demand league table.

Africa is forecast to experience strong demand from subsea development (DV) wells and will remain the largest region globally, requiring over 154,000 ROV days throughout the period to 2017. Africa is also forecast to be the largest expenditure market with total spend through the period 2013-2017 of $2.4billion.

Latin America is ranked second at $2billion while Asia is third at $1.4billion.

The Middle East has the lowest ROV spend; it is forecast at just $193million . . . an increase of just 5% over the previous period.

By contrast, Latin American ROV expenditure grows the most; increasing by 139%.

However, ROV expenditure is set to decrease over the period in both Norway and the Middle East. They are also expected to see a decrease in ROV days.

DW suggests that, as oil companies look to increase the profitability and efficiency of their subsea developments, there will be a surge of demand for exceptionally powerful work-class ROVs, able to perform the support work needed in an industry where new technologies and processes are vital.

Indeed, the move to ever deeper waters will drive demand for work-class ROVs and manufacturers will have to produce high specification models capable of performing at greater depths.

It is thought that smaller manufacturers may find there are opportunities to move from the production of inspection class and light work-class ROVs into the market for heavy-duty work-class ROVs.

Because the market outlook is so buoyant, DW also sees new entrants to the ROV fleet operator market.

However, it won’t be easy as the top 10 operators currently claim a total market share of around 84%; the top three commanding almost 60%.

Notwithstanding the possibility of new entrants, DW sees scope for further market consolidation.

Recommended for you