Global engineering group Kentz is set to buy US-based oil and gas services company Valerus Field Solutions in a £266 million all-cash deal.

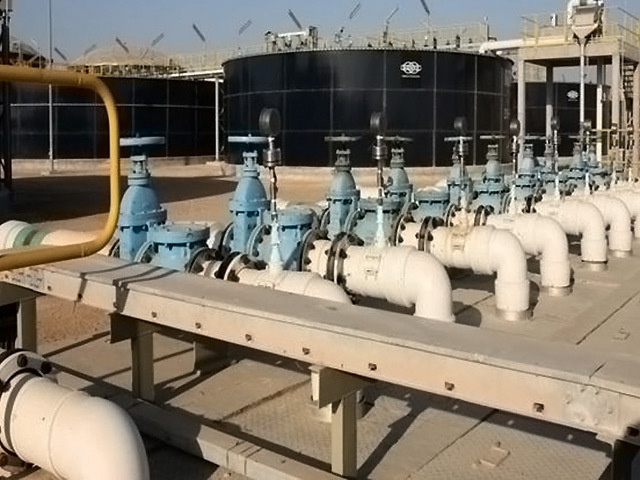

Kentz says acquisition of the US integrated oil and gas surface facility solutions provider will help increase the company’s exposure to high-value, high-margin contracts further up the value chain.

It will also boost the company’s employee base, currently totalling more than 14,500 staff across 30 countries, with the addition of 665 staff including 198 personnel with experience in gas handling and processing.

In addition, Kentz says Valerus will open up the company to the US onshore oil and gas market, including shale gas, as well as increase the company’s exposure to Latin American markets on the back of Valerus’ established presence in Brazil, Mexico, Colombia and Venezuela.

“We have achieved exceptional organic growth since listing in 2008. We have also highlighted our desire to expand our offering through selective acquisition that creates shareholder value,” said Kentz chief executive Christian Brown.

“The board of Kentz belives that, consistent with our strategy, the acquisition of Valerus Field Solutions will help to establish Kentz as a recognised market leader in providing highly skilled process engineering, EPCM and EPC services for small and medium-sized oil and gas processing facilities worldwide.

“It also provides us with a significant presence in the growing US market.”

Last year Valerus reported operating profits of £31million against a revenue of £301million.

Kentz says it expects the deal will boost earnings in the first full financial year of ownership and generate a return on investment exceeding the company’s pre-tax cost of capital.

Recommended for you